High capacity utilisation and accelerating rise in prices

According to Regional Network contacts, business sector activity continues to rise. As a result of the lockdown before Christmas, activity declined in household services, while the other sectors reported growth in activity. Contacts expect stronger growth over the next six months. At the same time, over half of the contacts reported capacity constraints, which is a higher share than in November. Contacts are facing recruitment difficulties, as well as logistics challenges and shortages of intermediate goods. Contacts have revised up their estimate for annual wage growth in 2022 to 3.7%, compared with 3.3% in November. The rise in prices has picked up and contacts expect an even stronger rise ahead.

High capacity utilisation and tight labour market

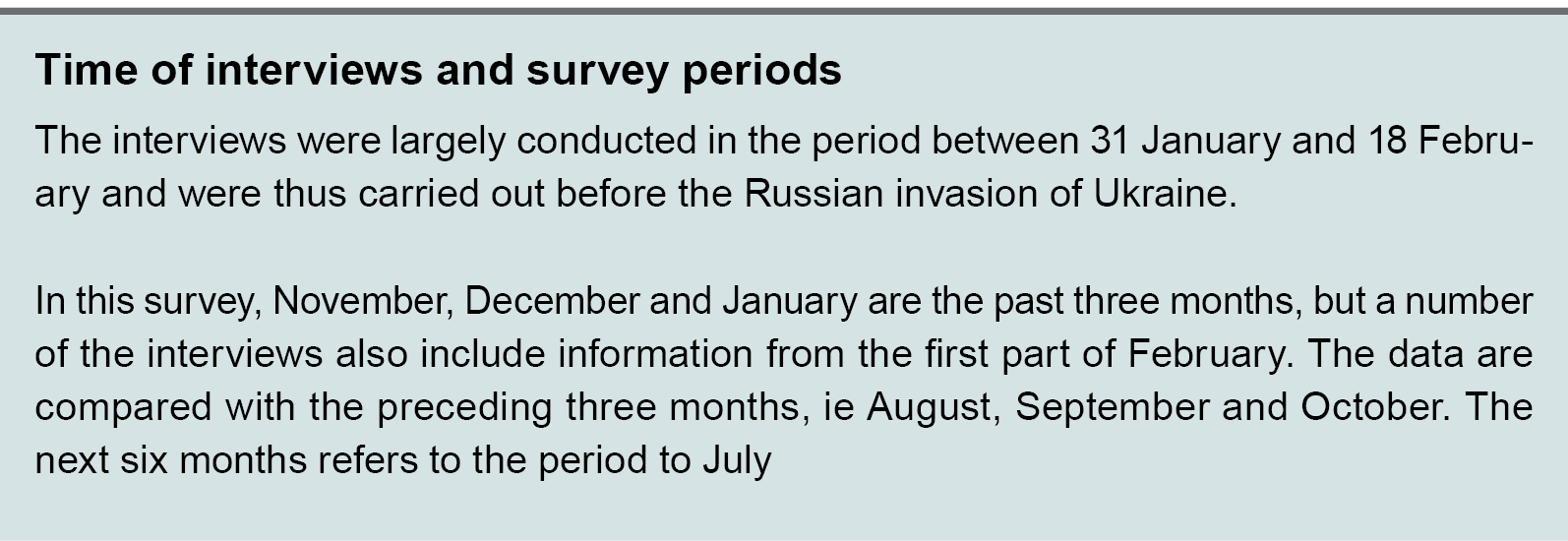

In this survey, nearly six in ten contacts report full utilisation of resources such as available intermediate goods, machinery and workforces (Charts 1 and 2). This share is higher than in the previous survey and is at the highest level since autumn 2007. Capacity constraints have increased in all sectors except retail trade.

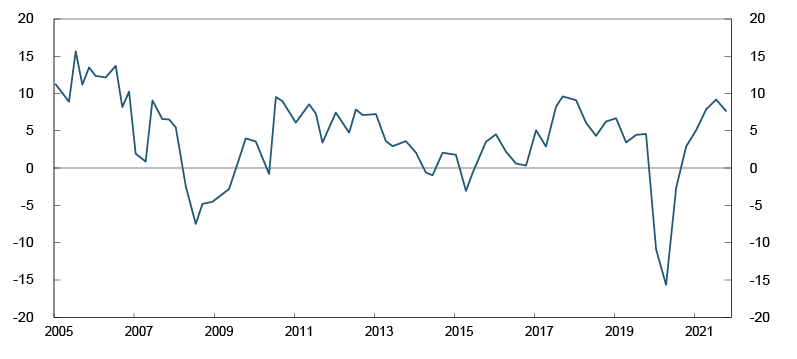

Chart 1. Capacity utilisation1 and labour supply constraints2 Percentage shares

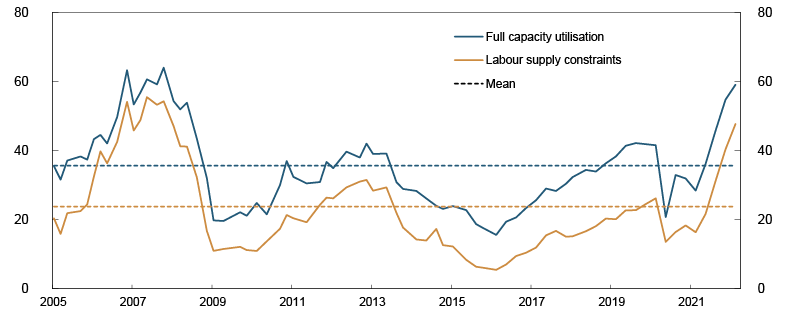

Chart 2. Capacity utilisation1 and labour supply constraints2 Percentage shares

Compared with before the Covid-19 pandemic, more than six in ten contacts report an increase in shortages of intermediate goods (Chart 3 in the special topic). Production constraints among suppliers are affecting slightly more than half of all contacts, while freight problems are affecting slightly fewer (Chart 4 in the special topic). Contacts that import goods from Asia in particular report transportation delays. About one in three contacts report increased competition for the intermediate goods they need. The majority of contacts expect that these problems will be solved in the last six months of 2022 or the first six months of 2023 (Chart 5 in the special topic).

There are substantial labour shortages, and close to half of contacts report difficulties finding employees with appropriate qualifications. This is the highest share since autumn 2007. The difficulties are most pronounced among enterprises with a high share of foreign labour, and recruitment difficulties are most widespread in oil services and construction. In services, over half of enterprises have also reported recruitment difficulties. Shortages are reported in a wide range of specialised occupational categories, for example engineers, economists, drivers and not least IT consultants. Many employees who previously worked in restaurants and tourism have found a job in other sectors. In this survey, high sickness absence rates have contributed to labour shortages, particularly in local governments and hospitals. Among these organisations, there is a sharp increase in the number reporting that they have too few employees at work.

Upward revision of wage expectations and accelerating rise in prices

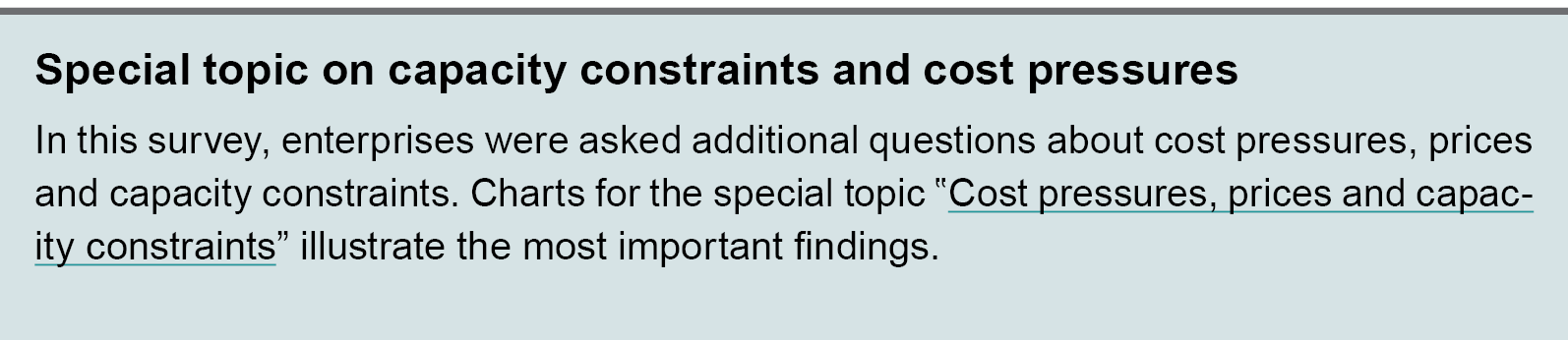

Contacts expect annual wage growth in 2022 to be 3.7% (Chart 3). The estimate has been revised up from 3.3% in the previous survey and is the highest since January 2013. Many enterprises report unusual difficulties in estimating wage growth for 2022. Private sector enterprises expect the sharpest rise in wage growth and now expect annual wage growth of 3.9%. The tight labour market and high inflation in particular are lifting wage expectations. Service enterprises expect the sharpest rise in wage growth, 4.1%, while other private sector enterprises expect a rise of between 3.6% and 3.8%. Local governments and hospitals largely refer to the central government budget. Overall, contacts report a wage growth estimate of 3.4%, but some expect higher wage growth.

Chart 3. Annual wage growth Expected annual wage growth. Percent

The rise in prices has continued to pick up, and the rise is the strongest since August 2008. Over 80% of contacts report a higher rise in costs than normal (Chart 1 in the special topic). Even though contacts report a sharp rise in prices over the past twelve months, a majority of contacts expect an accelerating rise in prices in the year ahead, reflecting high intermediate goods prices but also expectations of larger wage increases than observed in recent years.

Profitability improved this winter compared with one year ago, largely reflecting higher order levels, particularly in commercial services, manufacturing and oil services. Among many construction and retail trade enterprises, intermediate goods prices have risen faster than selling prices, dampening profitability. Moreover, a number of enterprises report that a sharp rise in energy costs has had a dampening effect on profitability.

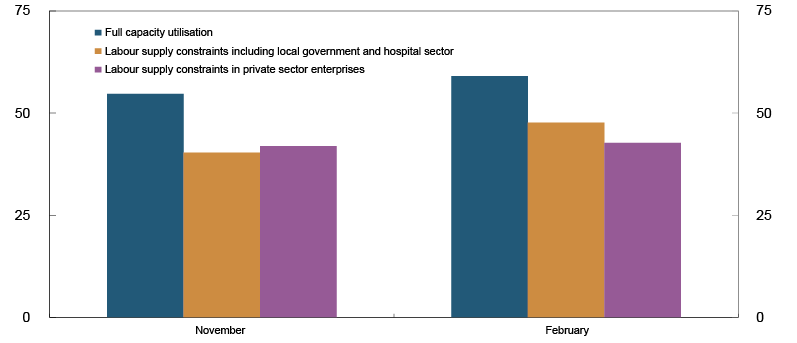

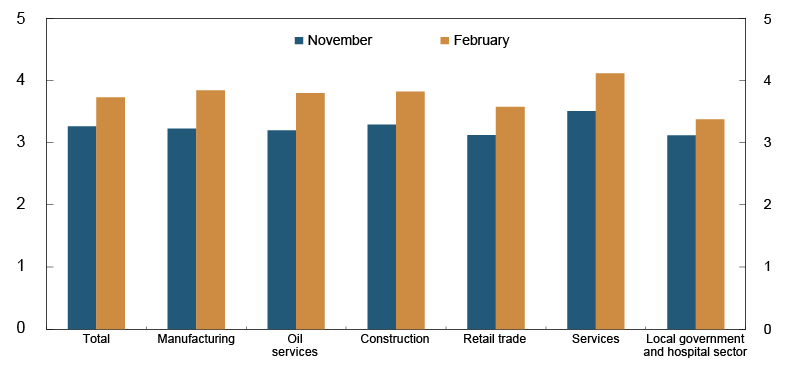

Chart 4. Total output growth Growth past three months and expected growth next six months. Seasonally adjusted. Annualised. Percent

Prospects for rising activity growth

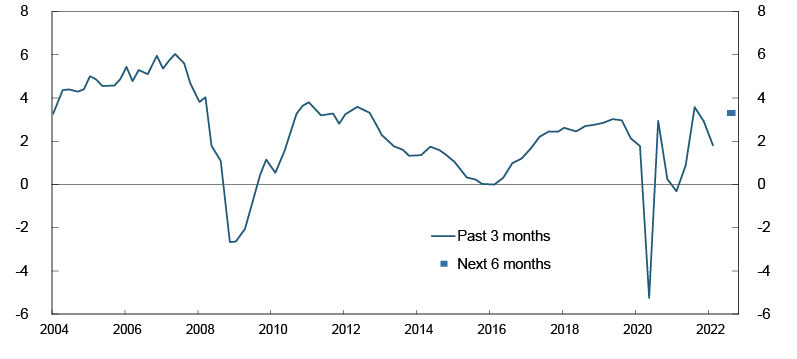

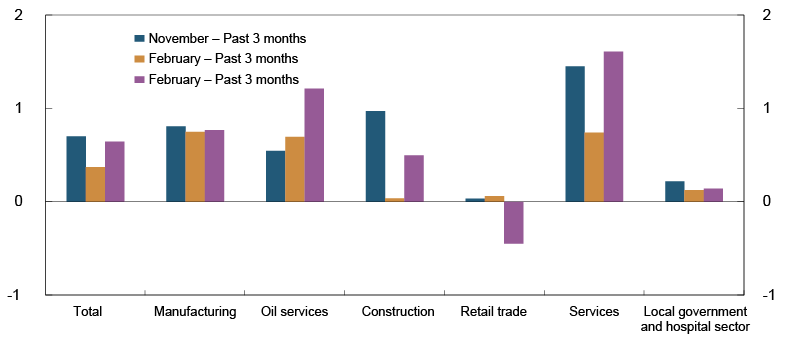

Over the past three months, activity growth has slowed. While household services contacts report a decline, activity in other sectors has been higher (Chart 5).

Chart 5. Output growth. All sectors Growth past three months and expected growth next six months. Seasonally adjusted. Annualised. Percent

Enterprises expect growth to pick up through spring and summer. Services contacts expect the strongest growth, but oil service and construction sector contacts also expect higher growth ahead. On the other hand, there are prospects for falling sales volume in retail trade. Contacts are less concerned about the evolution of the pandemic and Covid-related restrictions than previously. For many, uncertainty is primarily related to capacity constraints and a rapid rise in prices. Even though the interviews were conducted before the invasion of Ukraine, some enterprises indicated that any new sanctions on Russia would lead to lower order levels, with reference also made to equipment and services for Russian fishing and aquaculture.

Temporary fall in household services

Activity in household services has largely been influenced by infection rates and Covid-related restrictions since the beginning of the pandemic. The tightening of restrictions in December again led to a reduction in activity, although the decline appears to have been less pronounced than in previous lockdowns. Moreover, for most of the enterprises that were hard-hit, activity picked up quickly when restrictions were relaxed in January. Contacts expect strong growth over the next six months.

Through the pandemic, turnover has been unusually high in large segments of retail trade. Enterprises expect that customers will shift parts of their consumption from goods and back to services ahead. Contacts also expect greater trade leakage through increased border trade and an increase in holidaying abroad. Moreover, a number of contacts believe that a rapid rise in prices for their own goods, higher interest rates and high electricity bills will dampen turnover volume.

Higher public and private sector demand

Commercial services report greater demand over the past three months. Growth has slowed since the previous survey, but enterprises believe it will pick up again ahead. Demand for staffing services is rising sharply and is higher than what enterprises are able to provide. Contacts report increasing requirements for eco-friendly projects and a number of digitalisation projects. This boosts orders for technical consultancy and IT services, which continue to report strong growth. A favourable outlook for oil services boosts demand for a number of services. Increased optimism also contributes to solid growth expectations among, for example, communications companies, architects and lawyers.

Over the past three months, turnover among hotels, restaurants and canteens has again fallen. In autumn, hotels’ corporate customer activity picked up somewhat but stopped abruptly before Christmas. Looking ahead, contacts expect business sector spending on events, courses and conferences to recommence and demand for air travel and hotel accommodation to also increase. Contacts believe that a return to pre-pandemic levels will take time, but experiences in autumn suggest that a return to normal levels will be more rapid than first feared. Contacts expect demand from corporate customers to rise more ahead.

In construction, activity growth has slowed through winter, but enterprises expect rising growth ahead. Large public building and infrastructure projects in particular are pulling up expectations. Residential construction activity remains high, but higher construction costs and prospects for higher interest rates may dampen growth in residential construction. A number of contacts expressed concern about housing starts ahead.

Growth has edged lower in manufacturing

Output growth picked up during the first three surveys of 2021, but has fallen back somewhat through autumn and winter. Looking ahead, manufacturing contacts expect growth to remain approximately unchanged. Most enterprises describe demand in both domestic and international markets as solid. Some contacts report having a competitive advantage owing to European energy prices that are even higher than in Norway. Manufacturers of renewable energy products report increased demand. At the same time, an unusually large number of contacts report capacity constraints. In addition, some contacts describe the market as hesitant owing to very high raw materials prices. High raw materials prices and long delivery times will likely dampen growth, in both domestic and export markets.

Activity among oil service enterprises has recently increased and growth has picked up somewhat since November. Growth is reported in maintenance in particular, while the market for exploration remains weak. Enterprises expect activity to increase further over the next six months. The tax changes for the oil industry are in part supporting this but will have an even clearer impact in the period beyond the next six months.

Plans for solid employment and investment growth

Employment has continued to rise, albeit not as much as in the two previous surveys (Chart 6). The slower rise appears to be temporary. Looking ahead, enterprises expect the rise to be on par with summer and autumn 2021. Service and oil service enterprises are preparing for the greatest increase in staffing. On the other hand, retail trade enterprises plan to reduce staffing, primarily by making less use of extra staff.

Chart 6. Employment growth Growth past three months and expected growth next three months. Seasonally adjusted. Percent

Through 2021, enterprises gradually revised up their investment plans, and now expect considerable investment growth in the coming year (Chart 7). Retail trade contacts expect stable investment developments, while other sectors expect the pace of investment to rise. The highest growth estimate is in the local government and hospital sector, where growth expectations are particularly driven by hospital development projects and infrastructure.

Chart 7. Investment growth Expected growth next 12 months. Percent