Norway is a small and open economy, affected by events around us. In Norges Bank, we stand prepared to fulfil our mission, also in turbulent times.

After several years of high inflation, there has been a marked decline in a number of our trading partners. As a result, many central banks have lowered policy rates. Inflation has also eased in Norway, and although the time to ease up on the economic brakes is approaching, a restrictive monetary policy is still needed.

The global equity market has grown substantially, generating high returns for both the Government Pension Fund Global (GPFG) and Norges Bank’s foreign exchange reserves. The value of the GPFG increased by close to NOK 4 000 billion in 2024, reaching NOK 19 742 billion at the end of 2024. The value of the foreign exchange reserves increased by NOK 104 billion to NOK 789 billion in 2024.

The economic outlook is uncertain, with international political tensions and a risk of increased trade barriers. Considering the GPFG’s size with 70% allocated to equities, we must be prepared for considerable fluctuations in the GPFG’s return and value. International unrest may also affect monetary policy and the Norwegian financial system.

In a turbulent world, security and contingency preparedness will be of crucial importance, and Norges Bank is taking a systematic approach. We play a key role in ensuring an efficient and secure payment system and collaborate with other government bodies, the financial industry and other central banks to promote a stable financial sector.

In Norges Bank, we are 1 118 employees representing 44 nationalities. Most work at the Bank’s headquarters in Oslo, the rest at our offices in London, New York and Singapore. I would like to express my thanks to all my colleagues, whose expertise and strong commitment enable us to carry out Norges Bank’s mission.

Oslo, 25 February 2025

Ida Wolden Bache

Governor

Norges Bank’s Executive Board

The Executive Board comprises the Governor, the two Deputy Governors and six external board members, all appointed by the King in the Council of State. The Governor is Chair, and the two Deputy Governors are First Deputy Chair and Second Deputy Chair of the Executive Board. In addition, two board members are selected by and among employees to participate in the deliberation of administrative matters.

The Executive Board has four preparatory and advisory committees, whose work improves and streamlines the Executive Board’s discussions. For more information on the members of the Executive Board, see Norges Bank's website.

Work of the Executive Board in 2024

The Executive Board held 11 meetings and discussed 182 items of business. This is in line with previous years. Meetings in the form of seminars are also used for more in-depth discussions and presentations of the premises of important agenda items with Bank staff.

In addition, the Executive Board’s four subcommittees are used for the preparation of selected items for the Executive Board’s consideration.

Approximately two thirds of the Board’s time was spent on matters related to the management of the Government Pension Fund Global. This share has remained broadly unchanged since the Committee for Monetary Policy and Financial Stability was established.

Table 1 Work of the Executive Board 2020–2024

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

|---|---|---|---|---|---|

|

Number of Executive Board meetings |

20 |

14 |

14 |

13 |

11 |

|

Number of Executive Board seminars |

4 |

5 |

6 |

5 |

5 |

|

Number of matters considered by the executive board |

222 |

228 |

212 |

218 |

182 |

|

|

|

|

|

|

|

|

Committee meetings |

|

|

|

|

|

|

Audit Committee |

7 |

11 |

7 |

6 |

6 |

|

Remuneration Committee |

5 |

7 |

6 |

6 |

5 |

|

Ownership Committee |

7 |

9 |

7 |

8 |

8 |

|

Risk and Investment Committee |

10 |

13 |

13 |

9 |

11 |

Annual Report of the Executive Board for 2024

Introduction

The geopolitical situation has changed considerably in recent years. There is substantial uncertainty about the outlook for both the global and Norwegian economy. The risk of extensive trade barriers has increased, and the threat landscape has become more complex. This affects all aspects of Norges Bank’s remit and characterised the Executive Board’s work through 2024.

At the end of 2023, the policy rate was 4.5%. The interest rate has contributed to cooling the Norwegian economy and to dampening high inflation. Inflation slowed considerably through 2024 but remained above the 2% target. The Monetary Policy and Financial Stability Committee chose to keep the policy rate unchanged at 4.5% in 2024. See the Annual Report of the Monetary Policy and Financial Stability Committee for 2024 for further information.

The international equity market rose substantially in 2024, resulting in high returns for both the Government Pension Fund Global (GPFG) and Norges Bank’s foreign exchange reserves. The value of the GPFG increased by almost NOK 4 000bn in 2024 and was NOK 19 742bn at the end of 2024. The GPFG’s value was affected by the return on investments, capital inflows from the Norwegian government and exchange rate movements.

The market value of the total equity and fixed income portfolio in the foreign exchange reserves was NOK 758.2bn at the end of 2024, NOK 103.8bn more than in 2023.

Norges Bank is on schedule to achieve the ambitions in Strategy 25. The Bank is in the process of evaluating the next generation payment system. In November, Norges Bank signed an agreement on participation in the Eurosystem’s TARGET Instant Payment Settlement (TIPS) for instant payments. At the beginning of 2025, the Executive Board made a decision to enter into formal discussions with the European Central Bank (ECB) on participation in the T2 settlement system. Norges Bank’s assessment is that collaboration with Nordic and other European central banks is the best choice for secure and stable operation of the settlement system in the long term.

Climate and the environment is another priority area in Strategy 25. Norges Bank Investment Management (NBIM) works to ensure that investee companies align their activities with the Paris Agreement. In Central Banking, there are ongoing projects to improve the Bank’s understanding of the economic impact of climate change and energy transition.

Norges Bank works systematically with security and contingency arrangements. Prioritised areas include mapping and assessing the financial sector’s importance for national security, holistic security risk management, contingency plans for national security crises and war, as well as continuing initiatives in cyber security. The Bank has an extensive training programme and participates in national and international contingency exercises. The Ministry of Justice and Public Security has initiated “Totalforsvarsåret 2026” [Total Defence Year 2026], and Norges Bank has implemented a number of activities to prepare for this, including strengthening collaboration across societal sectors and with other Nordic central banks.

Norges Bank’s employees are the Bank’s most important resource, and the Bank works systematically to promote well-being, encourage employee development and ensure that employees have the right expertise to meet the Bank’s needs. The 2024 staff survey shows that Norges Bank has high overall scores in the areas covered by the survey. The Executive Board is satisfied with the results of the 2024 staff survey and assesses the working environment at the Bank as positive. The Executive Board would like to thank Norges Bank’s employees for their significant contributions throughout the year. See Society and social conditions for more information on Norges Bank’s employees.

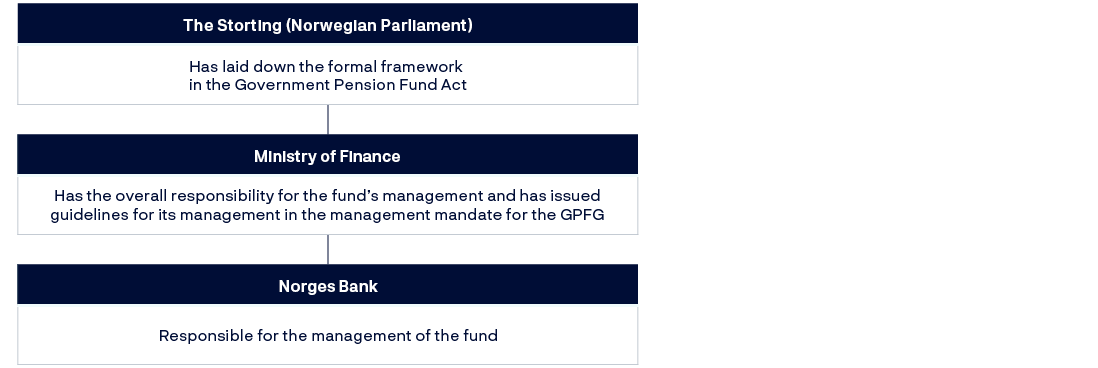

Government Pension Fund Global

Norges Bank manages the Government Pension Fund Global (GPFG) on behalf of the Ministry of Finance. The objective of the Bank’s investment management is to achieve the highest possible long-term return within the constraints laid down in the mandate from the Ministry of Finance.

The investments in the GPFG returned 13.1% in 2024 following strong gains in global equity markets. Nevertheless, the relative return was weak, with a return that was 0.45 percentage point below the GPFG’s benchmark index. The Executive Board emphasises the importance of assessing results over time and is satisfied that the return over time has been higher than the return on the GPFG’s benchmark index.

The value of the GPFG increased by almost NOK 4 000bn in 2024, to NOK 19 742bn. At the end of the year, the GPFG’s investments comprised 71.4% equities, 26.6% fixed income, 1.8% unlisted real estate and 0.1% unlisted renewable energy infrastructure.

Return on the Government Pension Fund Global

The value of the GPFG is affected by the return on the GPFG’s investments, capital inflows and withdrawals by the government and exchange rate movements. In 2024, the return measured in terms of the GPFG’s currency basket1 was equivalent to NOK 2 511bn. In addition, owing to a weaker krone, the value of the GPFG measured in NOK terms increased by NOK 1 072bn, but this has no bearing on GPFG purchasing power in foreign currency. Net transfers from the Norwegian government were NOK 402bn after the payment of management fees.

Measured in terms of the GPFG’s currency basket, the return for the year was 13.1% before management costs. Equities returned 18.2%. Solid corporate earnings in the investee companies and more optimistic growth expectations, together with declining inflation expectations, led to strong equity markets. A small number of companies now account for a substantial share of the GPFG’s benchmark index, owing to developments in equity markets in recent years. Several of the largest companies are in the technology sector, and this sector had the highest return in both 2023 and 2024.

Fixed-income instruments returned 1.3% in 2024 after bond yields rose somewhat over the year. Investments in unlisted real estate returned -0.6%. While the valuations of many of the GPFG’s unlisted real estate investments fell considerably in 2023, developments were more mixed in 2024. The office segment in the US remained weak, while some other market segments performed more positively.

The GPFG’s investments in unlisted renewable energy infrastructure returned -9.8%. The return on these investments comprises net income from the assets and changes in their value. Expected future power prices, expected future production volumes and the estimated cost of capital impact valuations. The value of the assets also falls as their expected remaining life decreases. In 2024, the negative return on unlisted renewable energy infrastructure was driven in particular by a higher cost of capital.

The Executive Board considers the overall return on the fund over time to have been good. In the period between 1998 and 2024, the average annual return was 6.3%. The annual net real return, after deductions for inflation and management costs, was 4.1% in the same period.

With such a large fund and an equity share of around 70 percent, we have to be prepared for considerable fluctuations in the GPFG’s return and value. Each year, the Bank publishes analyses of risk based on hypothetical scenarios designed to illustrate extreme market events over periods of up to five years. This year’s scenarios are related to a repricing of AI companies, a debt crisis and a more fragmented world of distinct economic blocs. The estimated decrease in the value of the GPFG in these scenarios ranges from 18% to 40%.

Return relative to the benchmark index

Norges Bank manages the GPFG with a view to achieving the highest possible long-term return, within the constraints laid down in the mandate from the Ministry of Finance. Results are measured against the GPFG’s benchmark index. In 2024, the GPFG’s return before management costs was 0.45 percentage point lower than the return on the benchmark index. This is within the range of variation in relative return that can be expected from one year to the next.

Norges Bank’s investment strategies are grouped into three main strategies: market exposure, security selection and fund allocation. These strategies are complementary and aim to take advantage of the GPFG’s size and long investment horizon.

Under the strategy for market exposure, the GPFG is invested broadly in the equities and bonds included in the benchmark index. The investments are made cost-effectively and with a view to contributing to the objective of the highest possible return. Market exposure contributed positively to the GPFG’s relative return in 2024.

The strategy for security selection is based on fundamental analysis of companies, and Norges Bank uses both internal and external managers. In 2024, the overall contribution from security selection was negative. External management made a positive contribution, but the negative contribution from internal management was larger. The security selection strategy is not expected to contribute positively to the GPFG’s relative return every year, and the results for 2024 followed a period of five consecutive years of positive contributions from security selection.

Norges Bank invests part of the GPFG in listed and unlisted real estate and in unlisted renewable energy infrastructure. These investments are funded by selling equities and bonds and form part of the fund allocation strategy. In 2024, the investments in real estate returned less than the equities and bonds the Bank sold to fund them and therefore served to reduce the GPFG’s relative return.

Investments in unlisted renewable energy infrastructure returned less than the bonds sold to fund them. As these investments made up only a small part of the GPFG, this had only a minor impact on the GPFG’s overall relative return.

While unlisted renewable energy infrastructure is a relatively new investment area for Norges Bank, we have been investing in unlisted real estate since 2010. The Executive Board assesses results over time and against a wide range of return metrics, including developments in the broad real estate market.

In recent years, real estate returns have been characterised by two periods of particularly negative performance. This was after the outbreak of Covid-19 in March 2020 and the rise in interest rates that started in earnest in 2022. These events have led to a negative contribution to the GPFG’s relative return from real estate investment and the funding of such investment.

In 2024, the GPFG also had a slightly smaller allocation to equities and a smaller allocation to the largest US technology companies than the benchmark index. This served to reduce the GPFG’s relative return in 2024 as returns were strong in both the broad equity market and the technology sector. These positions are intended to adjust the GPFG’s overall risk profile and are reported as part of the fund allocation strategy.

The Executive Board emphasises the importance of assessing the performance of the GPFG as a whole and over time and is satisfied that the overall return over time has been higher than the return on the GPFG’s benchmark index, against which the return is measured. In the period between 1998 and 2024, the average annual return before management costs was 0.25 percentage point higher than the return on the benchmark index from the Ministry of Finance.

Norges Bank has reported the contributions to the relative return from the strategies for market exposure, security selection and fund allocation in the period between 2013 and 2024. The annual return before management costs was also higher than the return on the benchmark index in this period. Market exposure and security selection made positive contributions to the GPFG’s relative return, while fund allocation made a negative contribution.

Risk and costs

The objective of the highest possible return is to be achieved with acceptable risk. A variety of risk analyses and calculations are used to obtain a full picture of the GPFG’s risk exposure, and the Executive Board receives regular analyses of the underlying risk in the management of the GPFG. The management mandate requires Norges Bank to manage the GPFG with a view to ensuring that expected relative volatility (tracking error) does not exceed 1.25 percentage points. At the end of 2024, expected relative volatility was 0.44 percentage point, compared with 0.34 percentage point a year earlier. Measured over the full period between 1998 and 2024, realised relative volatility was 0.63 percentage point. The Executive Board is satisfied with the excess return achieved over time given the risk taken in the management of the GPFG as measured by relative volatility.

The management of the GPFG is to be cost-effective. Low costs are not an end in themselves, but cost-effective management helps achieve the objective of the highest possible return after costs. In the period between 2013 and 2024, annual management costs averaged 0.05% of assets under management. In 2024, management costs amounted to NOK 7.4bn or 0.04% of assets under management. The Executive Board is satisfied that management costs are low compared with other managers.

For more information on the management of the GPFG, see the Government Pension Fund Global Annual Report for 2024.

Foreign exchange reserves

Norges Bank holds foreign exchange (FX) reserves for contingency purposes. The FX reserves are to be sufficiently large and liquid to be available for use in foreign exchange market transactions as part of the conduct of monetary policy or with a view to promoting financial stability and to meet Norges Bank’s international commitments. The aim of the management of the FX reserves is the highest possible return within the applicable risk limits. The FX reserves are divided into an equity portfolio, a fixed income portfolio and a petroleum buffer portfolio.

Equity and fixed income portfolio

The composition of the equity and fixed income portfolio must be adapted to the objective of the FX reserves. The Executive Board has set principles for the management of the FX reserves and annually receives an assessment from Norges Bank Markets on the strategy and management framework. The assessment for 2024 stated that the size, liquidity, currency composition and risk profile of the FX reserves are well adapted to the objective. The management of the foreign exchange reserves is considered to be efficient and prudent.

The market value of the total equity and fixed income portfolio was NOK 758.2bn at the end of 2024, which is NOK 103.8bn more than in 2023. At the end of 2024, the value of the equity portfolio was NOK 157.1bn, while the value of the fixed income portfolio was NOK 601.1bn.

In international currency terms, the return on the total equity and fixed income portfolio was NOK 49.1bn in 2024, or 6.2%. The return on the equity portfolio was NOK 39.6bn, while the fixed income portfolio returned NOK 9.5bn, equivalent to 22.2% and 2.0%, respectively.

In NOK terms, the return on the equity and fixed income portfolio was 15.4%, reflecting higher equity prices and current interest income. The krone depreciation further increased the return in NOK terms.

The FX reserves are managed close to benchmark indexes set by the Executive Board, and the return closely tracks global equity and bond market developments. In 2024, the return on the equity and fixed income portfolios was 0.07 percentage point and 0.03 percentage point higher than the return on the portfolios’ benchmark indexes, respectively. At the end of 2024, expected relative volatility for the equity and fixed income portfolios was 0.04 and 0.02 percentage point, respectively, approximately unchanged through 2024. Norges Bank’s financial risk arises from market exposure and different currency compositions on the asset and liability sides.

Over the past ten years, the annual return on the equity and fixed income portfolio has been 11.5% and 0.6% in international currency terms, respectively. The overall annual return has been 3.4%. The Executive Board is of the opinion that returns have been solid over time.

Petroleum buffer portfolio

The purpose of the petroleum buffer portfolio is to provide for an appropriate management of the government’s need for converting foreign currency and NOK, and for any transfers to and from the GPFG.

The size of the portfolio fluctuates owing to the purchase and sale of currency in the market, the purchase of foreign exchange from the State’s Direct Financial Interest (SDFI), monthly transfers to and from the GPFG and changes in foreign exchange rates. As in recent years, high oil and gas prices have also led to large capital flows and substantial volatility in the petroleum buffer portfolio in 2024.

At the end of 2024, the market value of the petroleum buffer portfolio was NOK 30.8bn, which is NOK 4.6bn less than in 2023. The return on the portfolio was NOK 7.5bn, owing to the krone depreciation and interest income.

For more information on the management of the FX reserves, see the report Management of Norges Bank’s foreign exchange reserves.

Tasks performed as the government’s bank

Government debt

Norges Bank manages government debt on behalf of the Ministry of Finance. The borrowing requirement is primarily met through issuing long-term fixed-rate bonds. The government also borrows short-term through Treasury bills, which are debt instruments with a maturity of one year or less. The government borrows exclusively in NOK.

At the end of 2024, government debt totalled NOK 615bn, with NOK 566bn in government bonds, and NOK 49bn in Treasury bills. Of this amount, the government’s own stock amounted to NOK 52bn in bonds and NOK 16bn in Treasury bills.

In 2024, bonds amounting to NOK 102bn were issued to the market. In February, a new 10-year bond was issued via syndication in the amount of NOK 20bn. In May, a new 15-year bond worth NOK 12bn was issued by syndication. This was the first time that a Norwegian government bond was issued with a 15-year maturity.

Existing bonds were reopened in the amount of NOK 70bn on 25 auction days. On most of these days, two bonds with different maturities were auctioned.

Treasury bills worth NOK 51bn were issued to the market at 18 auctions.

Owing to high volatility, unusually low liquidity and uncertainty in fixed income markets, Norges Bank has since summer 2022 permitted primary dealers to quote larger-than-normal yield spreads in the interdealer market for government bonds and Treasury bills. As liquidity improved somewhat through 2024, the option to quote larger yield spreads for all bills and bonds with a residual maturity of up to one year was terminated in Q3. For bonds with longer maturities, yield spreads were still larger than normal in the interdealer market at the end of 2024. The government’s borrowing requirement was met in line with the 2024 Strategy and Borrowing Programme.

NOK transactions on behalf of the government

In 2024, Norges Bank purchased foreign exchange equivalent to NOK 90.4bn. The volume of foreign exchange transactions carried out by the Bank on behalf of the government was substantially lower than in 2023, primarily reflecting a higher structural non-oil budget deficit and lower taxes paid by oil companies. The lower tax payments reflect lower petroleum prices in 2023 and 2024 compared with 2022 as oil companies pay taxes partly on income from the preceding year and partly on expected income for the current year.

Norges Bank is tasked with converting government revenues from petroleum activities on the Norwegian continental shelf so that the government receives the correct amount of NOK for spending via the central government budget and the correct amount of foreign exchange for saving in the GPFG. The transactions are carried out on behalf of the government, completely separate from monetary policy. The NOK sales must be seen in conjunction with oil companies’ NOK purchases.

Depositing to discharge debt

Throughout 2024, funds deposited at Norges Bank increased substantially. Depositing to discharge debt is an arrangement allowing debtors that cannot make repayments to discharge themselves from their debt by transferring money or securities to Norges Bank. At the end of 2024, outstanding deposits amounted to approximately NOK 769m, representing more than 19 000 cases, a doubling since the end of 2023. The increase in 2024 is primarily a consequence of the increased focus by Finanstilsynet (Financial Supervisory Authority of Norway) on financial institutions’ compliance with the Anti-Money Laundering Act.

The payment system

An efficient and secure payment system is essential for economic and financial stability. If payments cannot be made, economic activity comes to a halt. Being able to pay for goods and services is crucial for individuals to fully participate in society.

Norges Bank is tasked with promoting an efficient and secure payment system. Norges Bank is in charge of the ultimate settlement system for interbank payments in Norway and issues banknotes and coins. Norges Bank also oversees the payment system and other financial infrastructure and is the supervisory authority for interbank systems and contributes to contingency arrangements.

Norges Bank considers the financial infrastructure to be secure and efficient. Operations are stable, and payments can be made swiftly and at low cost.

Norges Bank’s settlement system

Norges Bank’s settlement system (NBO) is the core of the payment system. Payments between banks and other financial sector undertakings with an account at Norges Bank take place in NBO. Most NOK payments are therefore ultimately settled in NBO.

The operation of the settlement system was stable through 2024, with an average of NOK 350bn in payment transactions handled daily. At the end of 2024, banks’ sight deposits and reserve deposits with Norges Bank totalled NOK 38bn.

In line with Strategy 25, the process of overhauling the settlement system is underway. The Bank is evaluating the next generation payment system. In November, Norges Bank signed an agreement on participation in the Eurosystem’s TARGET Instant Payment Settlement (TIPS) solution for instant payments. The TIPS solution facilitates the sound development of Norwegian instant payments in the coming years and will provide Norges Bank with a clearer role in instant payment settlement. TIPS is scheduled for implementation in 2028. In 2024, Norges Bank explored whether the next generation of NBO should be based on the current model, with a dedicated system for Norges Bank or whether the Bank should participate in the Eurosystem’s T2 settlement system. At the beginning of 2025, the Executive Board decided to enter into formal discussions with the European Central Bank (ECB) to participate in the T2 settlement system.

Regardless of which platform is chosen, a decision has been made to implement measures to make the settlement system more component-based, in line with the IT architecture principles in Central Banking. The measures include isolating functions for the implementation of monetary policy and liquidity management and the establishment of a national contingency solution for NBO. The measures will strengthen contingency arrangements and simplify the transition to a new settlement system.

Cash

Norges Bank is tasked with meeting public demand for cash both in normal times and in contingency or crisis situations by supplying banks with cash.

The supply of cash in circulation was on average NOK 38.5bn in 2024, which was somewhat lower than in previous years and with less seasonal variation.

Although cash usage in Norway is very low in a global context, cash contributes to financial inclusion and plays an important contingency role.

In recent years, several regulations have been introduced to increase the availability of cash by clarifying banks’ obligation to offer their customers cash services. In 2024, consumers’ right to pay cash was also made clearer through the Financial Contracts Act. In total, this contributes towards giving the public real opportunities to obtain and use cash so that cash can fulfil its functions in the payment system.

Central bank digital currency

Norges Bank is assessing whether a Norwegian central bank digital currency (CBDC) is a suitable instrument for ensuring that the Norwegian krone remains an attractive and secure means of payment in the future.

Norges Bank has explored various aspects of a CBDC since 2016. The objective of introducing a CBDC would be to strengthen the payment system’s contingency arrangements and to contribute to payment system innovation through the use of new technology. A CBDC may have other benefits, for example if it is given legal tender status.

Norges Bank’s research has analysed the areas of application and characteristics of CBDCs and has experimented with CBDC payments in a test environment. Private banks and other financial sector undertakings have been invited to participate in the testing. Norges Bank is also collaborating with other central banks and international organisations in this work.

A distinction is made between retail and wholesale CBDCs in the Bank’s research. Potentially, a retail CBDC would be generally accessible to the public on a par with cash and bank deposits.

A wholesale CBDC would only be available to banks and other financial sector undertakings with an account at the central bank. This type of CBDC could be used for payment settlement in the same way as central bank reserves in the current payment settlement system, but in another technological form. Wholesale CBDCs are gaining increased international attention.

Norges Bank’s CBDC research will result in a report by the end of 2025.

Security and contingency arrangements in the payment system

Geopolitical developments in recent years have made working on payment system security and contingency arrangements both more important and more challenging than before. Compounding factors include rapid technological advances, increased globalisation and a more complex payment system.

The first line of defence will always be individual enterprises. Norges Bank supervises and oversees the payment system in order to promote a secure and efficient system. The Bank also collaborates with payment system participants and other national governing bodies on different measures for strengthening contingency arrangements. For example, the Bank is involved in testing the cyber resilience of critical functions and designing a framework for assessing IT-related risk.

For more information on the payment system, see Financial Infrastructure Report 2024.

Corporate governance

Norges Bank’s governance framework aims to be in line with best practice. The Executive Board follows up the Bank’s operations through periodic reporting on objectives, strategy implementation, resource use, financial and operational risk, as well as internal and external regulatory compliance.

Norges Bank’s use of resources is to be cost-efficient and prudent, with a cost level that is reasonable compared with that of peer organisations. Benchmarking, ie external comparisons of the Bank’s use of resources with that of other peer organisations, is used as a corporate governance tool.

On behalf of the Ministry of Finance, CEM Benchmarking has compared the management costs of the GPFG with around 270 other funds. The GPFG has the lowest costs in the peer group, measured as a share of assets under management. According to CEM, the costs are lower because management is mostly carried out internally, with a lower share of external management than in other funds. CEM also emphasises that the GPFG’s internal management is cost efficient.

A number of measures have been implemented to streamline Norges Bank’s operations, including some that aim to take advantage of synergies and economies of scale across the organisation.

The Executive Board follows up financial and operational risk and compliance through periodic status reports. Valuations, performance measurement, management and control of risk comply with internationally recognised standards and methods. See the notes to the financial statements for a detailed explanation. There were no material breaches of the limits for the management of the GPFG or the FX reserves in 2024, and operational risk exposure was within the Board’s risk tolerance limit throughout the year.

The Executive Board submits an annual risk assessment to Norges Bank’s Supervisory Council based on reporting by the administration and Internal Audit. No material deficiencies in the risk management and control regime were identified in 2024, and the Executive Board assesses the control environment and control systems at Norges Bank as satisfactory.

No directors’ and officers’ liability insurance has been provided for the members of the Executive Board or the chair of the Board, ie the Governor, in her role as general manager of Norges Bank. In practice, the Board members have limited liability risk, and the Bank self-insures any liability for damages on behalf of Board members or equivalent executive management positions. This is in line with practice in other Nordic central banks.

Balance sheet and financial statements

Balance sheet

Norges Bank’s balance sheet contains a number of items directly related to the Bank’s mission. The balance sheet total at the end of 2024 was NOK 20 722bn, compared with NOK 16 629bn at the end of 2023.

In line with the management mandate for the GPFG, the Ministry of Finance has placed a portion of the government’s assets in a separate account in Norges Bank (the GPFG krone account), presented as a liability to the Ministry of Finance. Norges Bank reinvests these funds, in its own name, and presents this as net value GPFG.

The value of the GPFG krone account will always equal the value of the investment portfolio less accrued management fees and deferred tax. Norges Bank, in its role as asset manager, bears no financial risk associated with the management of the GPFG. At year-end 2024, the GPFG’s value was NOK 19 742bn, compared with NOK 15 757bn at year-end 2023.

Detailed financial reporting for the investment portfolio of the GPFG is presented in note 20 to the financial statements. In addition, an annual report on the management of the GPFG is produced.

Excluding the GPFG, the FX reserves are Norges Bank’s largest balance sheet asset. The FX reserves are primarily invested in equities, fixed income instruments and cash. Net FX reserves amounted to NOK 789bn at year-end 2024, compared with NOK 690bn at year-end 2023. See the separate section above for more details on the management of the FX reserves.

Under the government’s consolidated account system, all government liquidity is collected daily in government accounts at Norges Bank. At year-end 2024, deposits amounted to NOK 274bn, compared with NOK 282bn at year-end 2023. Except for the GPFG krone account, this is the largest liability item on the balance sheet. However, this item fluctuates considerably through the year owing to substantial incoming and outgoing payments over the government’s accounts and transfers to and withdrawals from the GPFG.

Banknotes and coins in circulation are a liability item for Norges Bank. Norges Bank guarantees the value of this money. The amount of cash in circulation is driven by public demand. In recent years, lower demand for cash has reduced the amount in circulation. At year-end 2024, banknotes and coins in circulation amounted to NOK 38bn, compared with NOK 40bn at year-end 2023.

Deposits from banks, comprising sight deposits, reserve deposits and F-deposits, are managed by Norges Bank in accordance with its liquidity management policy. At 31 December 2024, these deposits amounted to NOK 91bn, compared with NOK 58bn at year-end 2023.

Norges Bank administers Norway’s financial obligations and rights ensuing from participation in the International Monetary Fund (IMF). Norges Bank has therefore both claims on and liabilities to the IMF. At year-end 2024, Norway’s net position with the IMF amounted to a claim of NOK 28bn, compared with NOK 27bn in 2023. See note 14 International Monetary Fund (IMF) in the notes to the financial statements for more details on the relationship between Norges Bank and the IMF.

Norges Bank’s equity at 31 December 2024 was NOK 387bn, compared with NOK 322bn at 31 December 2023. The Bank’s equity consists of the Adjustment Fund and the Transfer Fund. At year-end 2024, the Adjustment Fund stood at NOK 327bn and the Transfer Fund at NOK 60bn, compared with NOK 287bn and NOK 35bn, respectively, at year-end 2023. At 31 December 2024, Norges Bank’s equity, excluding the GPFG krone account, was 39.5% of the balance sheet total, compared with 36.9% at 31 December 2023.

The Executive Board deems that the Bank’s equity is sufficient to fulfil the Bank’s purpose (cf Section 3-11, Sub-section 1, of the Central Bank Act). This balance sheet composition is normally expected to generate a positive return over time, excluding foreign currency effects, as returns on the Bank’s investments in equities and fixed income instruments are expected to exceed the cost of the Bank’s liabilities.

Norges Bank’s assets are primarily invested in foreign currency, whereas its liabilities are primarily in NOK. Given the Bank’s balance sheet composition, income will largely be affected by developments in global fixed income, equity and foreign exchange markets. Considerable volatility in income should be expected from year to year. Future increases in the value of the GPFG will be affected by, among other things, transfers to and from the GPFG.

Income statement

Net income/expense from financial instruments

Net income from financial instruments was NOK 95.3bn in 2024, compared with NOK 71.2bn in 2023. Equity investments posted a gain of NOK 39.7bn, while fixed income investments posted a gain of NOK 9.1bn, compared with gains of NOK 30.5bn and NOK 18.6bn, respectively, in 2023. Net income from financial instruments in 2024 also includes a gain of NOK 58.9bn as a result of foreign currency effects. In 2023, the corresponding foreign currency effects resulted in a gain of NOK 30.3bn.

Government Pension Fund Global

The GPFG’s total comprehensive income showed a profit of NOK 3 575.9bn, comprising a gain on the portfolio of NOK 3 583.3bn net of management costs of NOK 7.4bn. Equity investments posted a gain of NOK 2 455bn, while fixed income investments posted a gain of NOK 71bn. The gain on the portfolio also includes a gain of NOK 1 072bn owing to foreign currency effects. Norges Bank’s total comprehensive income for 2023 showed a profit of NOK 2 616.4bn, comprising a gain on the portfolio of NOK 2 623.0bn and costs related to the management fee of NOK 6.6bn.

Total comprehensive income for 2024 was recognised against the GPFG krone account at 31 December 2024. The return on the portfolio, after management costs reimbursed to Norges Bank have been deducted, is transferred in its entirety to the krone account and thus does not affect Norges Bank’s total comprehensive income or equity.

Other operating income

In accordance with the management mandate for the GPFG, Norges Bank is reimbursed for its expenses related to the management of the GPFG up to a limit. Norges Bank was reimbursed by the Ministry of Finance in the amount of NOK 7.4bn in 2024, compared with NOK 6.6bn in 2023. Norges Bank also earns income from other services provided to banks and rent from external tenants. Income from these activities totalled NOK 183m in 2024, compared with NOK 161m in 2023.

Operating expenses

Operating expenses amounted to NOK 8.8bn in 2024, compared with NOK 8.0bn in 2023. NOK 7.4bn of the operating expenses in 2024 is related to the management of the GPFG, compared with NOK 6.6bn in 2023. See note 19 Related parties in the notes to the financial statements for more details on the management fee received by Norges Bank under the management mandate. The increase in expenses compared with 2023 is mainly related to the external management of the GPFG, foreign currency effects, personnel expenses and IT services, systems and data. Fees to external managers have increased owing to a rise in externally managed capital in 2024, foreign currency effects and higher excess return from individual external managers. Higher personnel expenses largely reflect general wage growth, foreign currency effects and a strengthening of the organisation in the form of more employees.

Total comprehensive income

Change in actuarial gains and losses showed a gain of NOK 1.0bn in 2024, compared with a loss of NOK 35m in 2023. Norges Bank’s total comprehensive income for 2024 showed a gain of NOK 95.1bn, compared with a gain of NOK 70.0bn in 2023.

Distribution of total comprehensive income

The distribution of total comprehensive income follows guidelines on the reserves and on the allocation of Norges Bank’s profit, laid down by Royal Decree of 13 December 2019 pursuant to Section 3-11, Sub-section 2, of the Central Bank Act. Total comprehensive income shall be allocated to the Adjustment Fund until this fund has reached 40% of the Bank’s net FX reserves. Any surplus is allocated to the Transfer Fund. A third of the Transfer Fund is transferred annually to the Treasury.

Of Norges Bank’s net gain of NOK 95.1bn, NOK 40.0bn was allocated to the Adjustment Fund and NOK 55.1bn to the Transfer Fund. A further NOK 30.1bn will be transferred from the Transfer Fund to the Treasury. The annual transfers and allocations for 2024 were made in accordance with the guidelines.

Funding transfers to the government

Norges Bank’s Executive Board has decided to purchase NOK by selling foreign currency from the FX reserves to fund the transfer from the Transfer Fund for the 2024 financial year. Transfer of the profit from Norges Bank’s operations and interest on the government’s deposit account are considered government revenue and are spent through the central government budget. Banks’ deposits in Norges Bank increase when the government spends transfers from Norges Bank. In the period to year-end 2024, the government has offset this increase by issuing government bonds equal to the transfers from Norges Bank. The Ministry of Finance has decided that the government will no longer issue debt for this purpose effective from the beginning of 2025. This decision was made on the basis of recommendations of a working group which examined the government’s transactions and the money market.

When Norges Bank funds transfers to the government by buying NOK in the market rather than crediting the government’s account with new NOK, banks’ deposits with Norges Bank are reduced correspondingly. This offsets the increase in banks’ deposits resulting from the government’s spending of the transfers. This means that the Executive Board’s decision continues the practice of neutralising the effect of the transfers on the banking system.

In order to minimise the effect on the foreign exchange market, Norges Bank will emphasise transparency and predictability when purchasing NOK.

1 Return on the Government Pension Fund Global (GPFG) is measured primarily in terms of international currency, a weighted composite of the currencies in the benchmark index for equities and bonds. At the end of 2024, the currency basket comprised 34 currencies. Unless otherwise stated, the results of the GPFG referred to in this Report are measured in terms of the GPFG’s currency basket.

Norges Bank’s Executive Board

Oslo, 5 February 2025

Ida Wolden Bache (sign.)

Governor / Chair of the Executive Board

Pål Longva (sign.)

First Deputy Chair

Øystein Børsum (sign.)

Second Deputy Chair

Ragnhild Janbu Fresvik (sign.)

Kristine Ryssdal (sign.)

Arne Hyttnes (sign.)

Hans Aasnæs (sign.)

Nina Udnes Tronstad (sign.)

Thomas Ekeli (sign.)

Guro Heimly (sign.)

Employee representative

Mats Bay Fevolden (sign.)

Employee representative

An account of corporate social responsibility and sustainability has been prepared pursuant to the Regulations on the financial reporting of Norges Bank. The report is presented in a separate document in the Annual Report. The report on sustainability is an integral part of the Executive Board’s report.

Norges Bank’s Monetary Policy and Financial Stability Committee

The Monetary Policy and Financial Stability Committee comprises the Governor, the two Deputy Governors and two external members.

The external members are appointed by the King in the Council of State for terms of four years. The Governor chairs the Committee, and the two Deputy Governors are First and Second Deputy Chairs.

The Committee had 24 meetings and considered 93 matters in 2024.

The Committee’s work structure

The Monetary Policy and Financial Stability Committee normally holds eight scheduled meetings a year, where policy rate decisions are made. Four of the meetings coincide with the publication of the Monetary Policy Report. The Report contains an assessment of the outlook for the Norwegian and global economy, and the analyses in the Report form the basis for the Committee’s assessments and decisions on the policy rate. At the interim monetary policy meetings, when the Monetary Policy Report is not published, the Committee also sets the level of the countercyclical capital buffer.

The Committee’s schedule is primarily determined by the dates of each monetary policy decision. The Committee usually meets four times in connection with each monetary policy decision that coincides with the publication of the Monetary Policy Report. The Committee also meets twice for each interim monetary policy decision. The Committee also has some seminars on specific topics.

Bank staff prepare economic analyses and projections that provide a basis for the Committee’s discussions and staff also advise the Committee on policy decisions. To ensure that the basis for discussions is as equal as possible for all Committee members, all members are given access to identical information and analyses simultaneously.

The Committee is committed to transparent and clear external communication and seeks consensus on its assessments and decisions through in-depth discussion. The “Monetary policy assessment”, published in connection with policy rate decisions, and the “Assessment of the countercyclical capital buffer requirement”, published in connection with the buffer decisions, reflect the view of the majority. Topics of particular concern to the members in the discussions are highlighted in the assessments. Members that disagree with the assessment of the majority may dissent, and dissenting views are published together with a brief written explanation in the minutes and in the assessments published at the same time as the rate decision. All of the Committee’s decisions were unanimous in 2024. To underpin the Committee’s form as a collegial committee, the Committee Chair, the Governor, normally speaks on behalf of the Committee. Other Committee members may issue statements by agreement with the Committee Chair.

Annual Report of the Monetary Policy and Financial Stability Committee for 2024

After the surge in inflation in spring 2022, Norges Bank raised the policy rate considerably, and at the end of 2023, the policy rate was 4.5%. The interest rate has contributed to cooling down the Norwegian economy and to dampening inflation. Inflation declined markedly in 2024 but was still above the target of 2%. The Committee decided to keep the policy rate unchanged at 4.5% in 2024.

In response to lower inflation, central banks in Norway’s main trading partners started reducing their respective policy rates in 2024. Inflation in Norway declined faster than projected through the year, but the rapid rise in business costs was expected to restrain further disinflation. The Committee assessed that a restrictive monetary policy was still needed to bring inflation down to target within a reasonable time horizon.

The Norwegian financial system is robust. Norwegian banks are profitable and solid. The vast majority of households and firms have been able to service debt in the face of higher costs and interest expenses in recent years. The countercyclical capital buffer rate was kept at 2.5% throughout 2024. In May, Norges Bank advised the Ministry of Finance to keep the systemic risk buffer requirement unchanged at 4.5%, and in line with the Bank’s advice, the Ministry decided to keep the requirement unchanged.

Monetary policy

The global economy

Following the pandemic and Russia’s invasion of Ukraine, prices for transport, energy and many other globally traded goods rose sharply. In many countries, consumer price inflation rose to the highest levels seen in several decades, peaking at the end of 2022. Lower energy prices contributed to the substantial decline in consumer price inflation through 2023. Underlying inflation among trading partners also slowed. In 2024, inflation fell further, but the decline softened among several trading partners.

To reduce inflation, central banks raised policy rates considerably in 2022 and 2023. In response to lower inflation, central banks in Norway’s main trading partners started reducing their respective policy rates in 2024. Many central banks communicated increased confidence that inflation would be close to targets ahead and that the current tight monetary policy stance was no longer warranted.

Policy rate cuts and growth in real wages helped maintain economic growth among trading partners in 2024. Wage growth slowed in 2024 but remained high in a number of countries. In December, there were prospects that economic growth would pick up somewhat in 2025.

Market-based expectations of global policy rates fluctuated widely over the course of the year. At the beginning of 2024, market participants expected policy rates to be cut substantially in the coming years. Policy rates were cut less than expected in 2024, and policy rate expectations were markedly higher at the end of the year than at the beginning of the year.

Financial conditions in Norway

The krone, as measured by the import-weighted index I-44, depreciated significantly in 2022 and in the period to summer 2023. The depreciation coincided with a sharper rise in interest rates abroad than in Norway. The krone depreciated somewhat through 2024, but compared with summer 2023, the exchange rate was slightly stronger at the end of 2024.

Household interest expenses rose substantially owing to policy rate hikes and remained high in 2024. Firms’ bank financing and bond market financing also became more expensive as a result of the rate hikes. Financing costs in the bond market declined slightly in 2024, while banks’ lending rates remained elevated. At the end of 2024, the benchmark index on the Oslo Børs was higher than at the end of 2023.

Norwegian economy

Following a period of high activity, the Norwegian economy reached a cyclical peak towards the end of 2022. The rise in interest rates helped cool the economy, and in 2023 growth was low. Unemployment edged up from a low level and according to Norges Bank’s Regional Network, recruitment difficulties eased. The employment rate declined from a high level.

Economic growth picked up slightly through 2024. The increase in unemployment slowed, and in December 2024, registered unemployment was still lower than before the pandemic. Overall output in the Norwegian economy appears to have been around potential throughout the year. In Q4, Regional Network enterprises overall expected growth to increase somewhat at the beginning of 2025.

Economic activity was higher in 2024 than envisaged at the start of the year. Household consumption, petroleum investment and public demand in particular were higher than expected. On the other hand, mainland business investment and housing investment were lower than expected.

There were marked differences between industries also in 2024. High petroleum investment contributed to continued strong growth among firms supplying goods and services to the petroleum sector. Firms in the services sector also reported strong business sector and household demand. In construction, activity again fell substantially in 2024 partly owing to weak new home sales.

While very few new homes were sold, activity in the secondary housing market picked up through 2024. The number of unsold homes fell, and prices of existing homes increased more than expected. In December, existing home prices were 6.4% higher than in the same month a year earlier.

The labour market held up better in 2024 than expected at the beginning of the year. Employment continued to rise, and wage growth was high. According to preliminary figures from Statistics Norway published at the beginning of February 2025, annual wage growth was 5.7% in 2024, higher than in the forecast presented in December 2024. High wage growth over the past couple of years reflects high inflation, a tight labour market and sound profitability in some business sectors. At the end of 2024, there were prospects of high nominal wage growth also in 2025, albeit lower than in 2024.

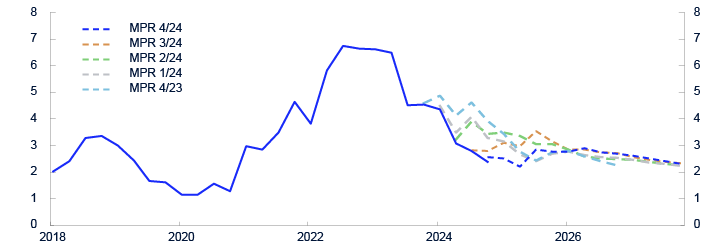

Chart 4 Unemployment. Registered unemployed as a percentage of the labour force. 2018 Q1-2027 Q4

Sources: Norwegian Labour and Welfare administration (Nav) and Norges Bank.

Consumer price inflation slowed substantially in 2024 and was generally lower than expected. Imported goods inflation in particular declined markedly. Domestically produced goods and services inflation also declined but to a much smaller extent than imported goods inflation. Rent growth and the rise in prices for some services remained elevated through 2024. The annual rise in the consumer price index (CPI) was 3.1% in 2024, a decline from 5.5% in 2023. The CPI adjusted for tax changes and excluding energy products (CPI-ATE) rose by 3.7% in 2024, also appreciably lower than the 6.2% rise in 2023.

Norges Bank’s Expectations Survey shows that inflation expectations for the coming years have fallen since 2023, but long-term inflation expectations remained somewhat over the inflation target of 2% at the end of 2024.

Monetary policy trade-offs

The operational target of monetary policy is annual consumer price inflation of close to 2% over time. Inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to countering the build-up of financial imbalances.

After the policy rate was raised to 4.5% in December 2023, the Committee’s assessment was that the rate was sufficiently high to return inflation to target within a reasonable time horizon. Monetary policy had a tightening effect, and the economy cooled. At the same time, business costs had risen considerably in recent years, and continued high wage growth and the krone depreciation in 2023 were expected to restrain disinflation. The Committee was therefore of the opinion that a continued tight monetary policy stance would likely be needed for some time ahead.

In its monetary policy assessments through 2024, the Committee emphasised that inflation was still above target, despite having declined and being lower than expected. Before summer 2024, there were signs of higher-than-expected activity in the Norwegian economy, and wages appeared to rise more than projected. This could imply that inflation would be higher than previously projected, and the Committee judged it necessary to maintain a tight monetary policy stance for somewhat longer than previously signalled.

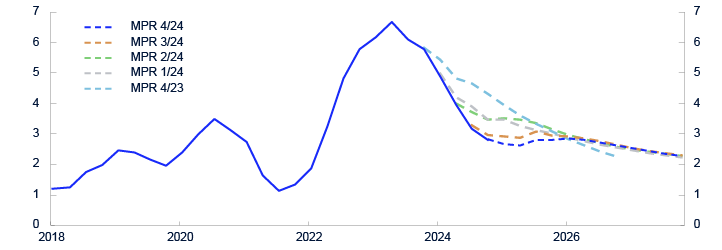

Chart 6 Estimated output gap. Percent. 2018 Q1–2027 Q4

Source: Norges Bank

Inflation declined further after summer but remained above target. The Committee was concerned with the risk that if the policy rate was lowered prematurely, inflation could remain above target for too long. On the other hand, an overly tight monetary policy stance could restrain the economy more than needed. When assessing this trade-off, the Committee concluded at its meeting in September that it was appropriate to keep the policy rate at 4.5% for a period ahead, but that the time to ease monetary policy was approaching.

Towards the end of 2024, inflation had moved closer to target, but the rapid rise in business costs was expected to restrain further disinflation. The Committee’s assessment at the monetary policy meeting in December was that restrictive monetary policy was still needed to stabilise inflation around target. The Committee also signalled that the rate most likely would be lowered in March 2025.

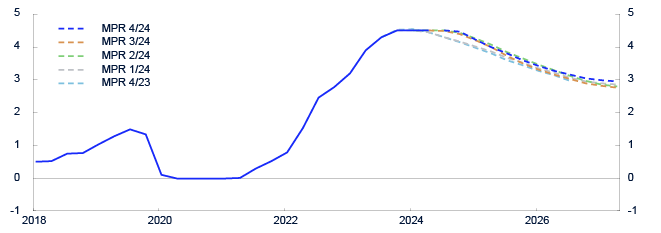

The forecast in the December 2024 Monetary Policy Report indicated a gradual reduction in the policy rate from 4.5% in 2025 Q1 to around 3% in 2027. Unemployment was projected to rise slightly. There were prospects that inflation would be just over 2% at the end of 2027.

The Committee was concerned with the substantial uncertainty regarding the global and domestic economic outlook.. At the monetary policy meeting in December, the Committee also discussed the risk of an increase in international trade barriers. Higher tariffs will likely dampen global growth, but the implications for the inflation outlook in Norway are uncertain. The Committee also noted that inflation in Norway was declining faster than expected through 2024. Should there be prospects of inflation continuing to decline faster than expected or a further increase in unemployment, the Committee was of the opinion that the policy rate could be lowered faster than envisaged. On the other hand, if wage and price inflation were to remain elevated for longer, a higher policy rate than envisaged in the December 2024 Monetary policy Report could then be required.

Monetary policy through 2024

The policy rate forecast at the end of 2023 indicated a policy rate that remained at 4.5% until autumn 2024 before gradually declining.

In line with the forecast, the policy rate was kept unchanged at all meetings in the first half of 2024, but at the monetary policy meeting in June, an upward revision of the inflation projection contributed to a slight upward revision of the policy rate path. The new forecast indicated that the policy rate would continue to lie at 4.5% through 2024 before gradually declining. The rate was also kept unchanged at all monetary policy meetings in the second half of 2024. The policy rate path presented at the monetary policy meeting in September was little changed in the near term but indicated a slightly faster decline in the policy rate in 2025. This was mainly owing to prospects of a more rapid decline in inflation than previously projected. The policy rate path presented at the monetary policy meeting in December was little changed from September but indicated a somewhat smaller rate reduction in the coming years. The upward revision of the policy rate path was partly due to activity in the Norwegian economy appearing to be holding up better than previously projected.

Chart 9 Policy rate. Projections at different times. Percent. 2018 Q1 – 2027 Q4

Source: Norges Bank

Financial stability and the basis for Norges Bank’s decision on the countercyclical capital buffer and advice on the systemic risk buffer

Norges Bank has decision-making authority for the countercyclical capital buffer (CCyB) and formalised advisory responsibility for banks’ systemic risk buffer (SyRB). The two buffer requirements account for a substantial portion of banks’ total capital requirements. The Monetary Policy and Financial Stability Committee sets the CCyB rate each quarter and advises on the SyRB rate at least every two years.

The objective of the CCyB is to strengthen banks’ resilience and mitigate the risk of banks’ credit standards amplifying an economic downturn. The CCyB requirement has remained unchanged at 2.5% since 2023 Q1.

The SyRB is intended to contribute to ensuring that banks hold sufficient capital to weather future downturns. In May 2024, the Committee decided to advise the Ministry of Finance to retain the SyRB requirement at 4.5%. In its assessment, the Committee placed particular weight on the high indebtedness of many households and banks’ high exposure to commercial real estate (CRE). The Committee also gave weight to banks’ substantial exposure to customers vulnerable to climate transition and that one bank’s funding is another’s liquidity reserve. In August, the Ministry of Finance decided to keep the SyRB requirement unchanged at 4.5%, in line with Norges Bank’s advice.

In Financial Stability Report 2024 H1 and Financial Stability Report 2024 H2, the Committee considered the financial system to be robust. In its assessments, the Committee emphasised that the vast majority of households and firms had been able to service debt in the face of high inflation and higher interest rates. At the same time, the Committee highlighted the importance of maintaining financial system resilience so that vulnerabilities do not amplify an economic downturn.

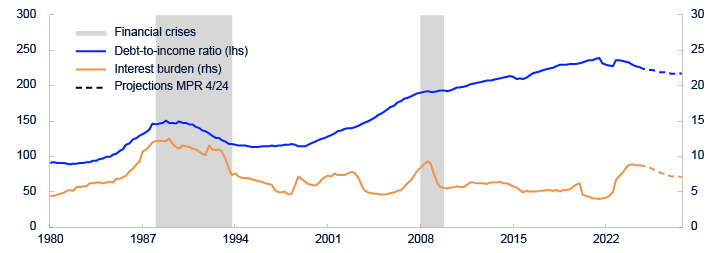

The high indebtedness of many households is a key vulnerability in the Norwegian financial system. In 2024, house prices rose by 6.4%. Credit growth accelerated somewhat through autumn 2024 but was still at a low level at the end of the year after having fallen over a long period. In recent years, household debt has risen less than income. High inflation and rising interest rates have led to tighter finances for most households. However, default rates have remained low, reflecting high employment and the sound financial basis of most households provided by financial buffers. Analyses in Financial Stability Report 2024 H2 indicate that the vast majority of households are able, by an ample margin, to service debt and cover ordinary consumption expenditure, housing expenses and electricity out of current earnings.

Banks’ high CRE exposure is another key financial system vulnerability. Higher interest rates have weakened CRE firms’ profitability. After declining sharply through 2023, estimated commercial property prices were unchanged in 2024. High employment and rental income growth enable most CRE firms to cover higher interest expenses with current earnings. Through 2024, credit premiums on CRE firms’ bank and bond financing fell, which has likely reduced refinancing risk for debt maturing in the coming years. According to the Committee’s assessment in Financial Stability Report 2024 H2, CRE prospects in 2024 improved somewhat compared with 2023.

The share of bankruptcies among Norwegian firms has risen in recent years. In 2024, the rise was particularly pronounced among real estate developers. Profitability for real estate developers has been impaired owing to higher interest rates, high construction costs, low residential construction activity and sluggish new home sales. Bankruptcy rates in most other sectors also increased somewhat but were still lower at the end of 2024 than before the pandemic. Analyses in Financial Stability Report 2024 H2 indicate that the corporate bankruptcy rate in Norway is likely to rise somewhat further, especially in the real estate sector.

Resilient banks are important for financial stability. Norwegian banks satisfy capital and liquidity requirements by a solid margin and are well-equipped to absorb higher losses. In 2024, banks were highly profitable and had ample access to both deposits and wholesale funding. Both creditworthy firms and households had ample access to credit through 2024.

In 2024, Norges Bank submitted its consultation response to the Ministry of Finance concerning amendments to the Capital Requirements Regulation (CRR). These amendments completed, among other things, measures proposed by the Basel Committee on Banking Supervision to increase banks’ resilience to crises. On the whole, Norges Bank supported the proposed national amendments.

In 2024, Norges Bank also submitted its consultation response to the Ministry of Finance concerning changes to the Lending Regulations. In the consultation response, the Monetary Policy and Financial Stability Committee highlighted the importance of retaining the Regulations and supported Finanstilsynet’s (Financial Supervisory Authority of Norway) proposal to continue all elements in the Regulations. The Committee’s assessment was that the Regulations have set limits on banks’ lending practices and dampened the build-up of vulnerabilities in the household sector. Permanent Lending Regulations would contribute to predictability and counter future deterioration of banks’ credit standards. The Regulations should, however, be reassessed at regular intervals. It is important to expand knowledge about the effects of the Lending Regulations and the consequences of the individual elements. Given that the other requirements in the Regulations are maintained, the Committee proposed some adjustments to the Regulations, such as raising the maximum LTV ratio from 85% to 90%. Moreover, the Committee proposed that banks, in their assessments of customer debt-servicing capacity, should be able to give greater weight to the risk-mitigating effect of fixed-rate loans than is currently the case. In December 2024, the Ministry of Finance decided to maintain the requirements in the Lending Regulations with some adjustments and followed Norges Bank’s advice when updating the Regulations.

Norges Bank’s Monetary Policy and Financial Stability Committee

Oslo, 17 February 2025

Ida Wolden Bache (sign.)

Governor / Committee Chair

Pål Longva (sign.)

First Deputy Chair

Øystein Børsum (sign.)

Second Deputy Chair

Ingvild Almås (sign.)

Steinar Holden (sign.)

Corporate social responsibility and sustainability

This section provides an overview of Norges Bank’s sustainability work. Key topics in this section are:

- Society and social conditions

- Ethics, responsible procurement and supplier and contractor monitoring

- Climate risk, climate impact and carbon accounts

Norges Bank’s sustainability strategy guides this work.

Society and social conditions

Norges Bank’s employees

Norges Bank’s employees are the Bank’s most important resource. Safe and sound working conditions must be standard for everyone who works at the Bank. The Bank works to ensure job satisfaction, stimulating work and the expertise necessary to fulfil the Bank’s mission. Skilled and motivated employees are a prerequisite of success. It is therefore necessary to attract, develop and retain skilled and engaged managers and employees.

The 2024 staff survey showed positive results overall. Compared with other organisations in Norway, Norges Bank has a higher average score in all comparable areas. The working environment is generally regarded as supportive and appreciative, but follow-up is required in some areas. The Bank continuously strives to facilitate a positive and inclusive working environment.

Policies aimed at increasing the share of women are achieving results. The share of women in Norges Bank has increased from 35% to 38% over the past three years and is approaching the target of 40%. The positive trend is due to an increase in the share of women in NBIM from 29% to 35%. In Central Banking, there has been a small decline from 43% to 42%. Although there has been a positive development in the overall gender balance in recent years, some specialist areas and position categories still lag behind. It is positive that both the retention and recruitment rates for female employees have increased.

The number of applications for positions at Norges Bank has also increased substantially in recent years.

Recruitment

Norges Bank works systematically to attract and recruit top candidates from leading national and international institutions. To ensure that the Bank is best equipped to fulfil its mission, recruitment efforts seek to attract staff with a wide range of experience, perspectives, knowledge and expertise. To increase diversity in the organisation, the Bank recruits irrespective of nationality, gender, age and background.

There was a significant increase in the number of applicants in the period between 2022 and 2023, and the trend continued in 2024, reflecting improved recruitment initiatives and increased awareness of Norges Bank’s mission.

Employer branding

A wide range of measures and activities are used to inform students and pupils about Norges Bank:

- Visits to Norges Bank’s Knowledge Centre

- Lectures in economics, finance and technology at schools and universities through the Norges Bank Teaching Initiative and NBIM Teach

- Annual nationwide case competition for students and pupils

- Part-time student internships

- Summer trainee positions for students and graduate programmes that offer personal and professional development

- Women’s Investment Summit where NBIM invites more than 100 students from Norway and abroad in order to motivate female students to pursue a career in finance.

Non-discriminatory recruitment

In 2024, Norges Bank introduced a number of recruitment measures and activities to promote diversity and prevent discrimination. The Bank has improved its job advertisements to ensure that they do not use discriminatory language or include unnecessary requirements. A diversity statement is now included, outlining how the Bank promotes diversity and providing relevant examples. The Bank is particularly alert to the risk of discrimination based on name, ethnicity or unconscious bias favouring certain candidates.

Managers handling recruitment processes are trained to be alert to diversity issues, and the measures implemented will be monitored going forward.

Table 2 Gender distribution among job applicants, upon signing of employment contract

|

Norges Bank |

Central Banking |

NBIM |

||||

|---|---|---|---|---|---|---|

|

Percentageapplicants |

Percentage staff |

Percentageapplicants |

Percentage staff |

Percentage applicants |

Percentage staff |

|

|

Men |

66 |

56 |

68 |

51 |

66 |

60 |

|

Women |

31 |

44 |

32 |

49 |

30 |

40 |

|

Not stated |

3 |

|

|

|

4 |

|

Learning and development opportunities

Norges Bank believes in life-long learning and seeks to provide its employees with the opportunity to build relevant skills throughout their careers. This is an important part of the Bank’s initiatives to retain motivated and engaged employees.

Management development

Managers in Norges Bank are trained in the Bank’s management principles and learn what the Bank expects from them. Managers must validate employees and build a common culture through regular follow-up combined with targeted, inclusive and supportive management. The management principles are presented at management meetings and training sessions throughout the year. The Bank is focused on developing skills to promote an efficient organisation, harnessing the power of digital tools and new technologies.

Employee development

Norges Bank’s aim is that all employees have a meaningful and targeted development plan. In 2024, the Bank has prioritised this work and the majority of the Bank’s employees now have individual development plans.

The Bank clarifies what it expects from its employees through activities and initiatives where future skill requirements are explored.

The Bank works to develop employee skills. In 2024, the Bank held courses on the climate, geopolitics, security and contingency preparedness, communication, technology and various forms of data analysis. In 2025, the Bank will further develop employee training, with particular emphasis on communication, technology and a deeper understanding of the Bank’s operations and processes.

Norges Bank has a career framework with a career ladder that describes responsibilities at each level, thus clarifying what is needed to achieve career progression.

Succession planning and internal mobility

In 2024, Norges Bank has intensified efforts to improve succession planning. This is important to avoid vulnerabilities related to critical positions and expertise, while opening the door for internal candidates.

The Bank promotes internal mobility. Employees gain experience and a better understanding of the Bank across operational and specialist areas through temporary internships both in Norway and at NBIM’s offices abroad. Employees can also apply for residency at other central banks and relevant institutions.

Retiree consultants

When an employee wishes to retire, the Bank can offer them a retiree consultant position, facilitating gradual transition to retirement. By employing retiree consultants, the Bank retains experienced employees, which enables them to continue to participate in working life also after formal retirement.

Diversity and inclusion

Norges Bank aims to be recognised as a leading institution in its fields of expertise and views increased diversity and inclusion as a means to this end. Diversity adds perspectives, stimulates creativity and improves decision-making.

In recent years, the Bank has focused on promoting a culture of inclusivity in which managers and employees contribute to develop a speak-up culture. A safe working environment contributes to a culture of acceptance and makes it easier to encourage and leverage different perspectives.

Norges Bank’s annual staff survey is an important tool in the Bank’s work to develop its staff, organisation and workplace. The survey covers both the physical and the psychosocial working environment. Survey results are reviewed by the Executive Board, management groups and various working committees, and measures are implemented based on discussions in the management groups and individual teams.

In 2024, new questions in the survey measured how diversity and inclusion are perceived. In the organisational units where employees experience positive management and psychological safety, they also perceive a higher degree of diversity and inclusivity. In the units where employees perceive a high degree of diversity and inclusion, there is a more room to put forward ideas and a greater willingness to change.

The survey results show that men and women experience equal opportunities for professional development in their roles. Initiatives to promote a sound work-life balance must also be continued, and the Bank has facilitated a flexible working arrangement. The Bank has both internal and external resources that can advise on issues related to personal and professional development, mental health and performance. Team development workshops and activities that promote awareness and inclusive behaviour will also be continued.

The Executive Board approved HR principles at Norges Bank. These govern the Bank’s initiatives within equality, anti-discrimination, diversity and inclusion. Under the Bank’s ethical rules there is zero tolerance for discrimination, harassment and bullying. Norges Bank has clear requirements and expectations that everyone at the Bank will treat others with respect and seeks to maintain a culture in which reporting of mistakes and unacceptable conditions is viewed positively. Inclusion means that employees feel that they can be themselves, that they can utilise their skills and experience a sense of community working together towards fulfilling the Bank’s mission.

Processes for salary setting, employee development and succession planning are seen as a whole to ensure that opportunities for advancement to senior and management roles are linked to performance and compliance with Norges Bank’s values, not conscious or unconscious bias.

Gender balance and gender distribution

Norges Bank has in recent years strived and managed to raise the share of female employees. The share of female employees increased from 35% in 2022 to 38% at the end of 2024. The Bank’s gender balance target is at least 40% representation of each gender, both overall in Norges Bank and among managers and specialists.

Norges Bank is one of the founding partners of Norway’s Women in Finance Charter, and in 2024, the Bank hosted the Charter’s third annual status report. The purpose is to increase women’s representation in leading positions in the Norwegian financial sector. The obligations ensuing from the Charter’s four principles are published on Norges Bank’s website.

The Bank works systematically to identify the risk of discrimination or other obstacles to gender equality by mapping and analysing HR data, conducting staff surveys and performance appraisals and through health, safety and the environment (HSE) work.

Greater detail is provided below on gender balance developments in Norges Bank overall, specified by job category and managerial and specialist position.

Table 3 Gender balance

|

Norges Bank |

Central Banking |

NBIM |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

2024 |

2023 |

2022 |

2024 |

2023 |

2022 |

2024 |

2023 |

2022 |

|

|

Men, number |

695 |

686 |

655 |

257 |

247 |

242 |

438 |

438 |

406 |

|

Women, number |

423 |

393 |

352 |

185 |

178 |

186 |

238 |

216 |

166 |

|

Men, percent |

62 |

64 |

65 |

58 |

58 |

57 |

65 |

67 |

71 |

|

Women, percent |

38 |

36 |

35 |

42 |

42 |

43 |

35 |

33 |

29 |

The share of women in Norges Bank is now 38% after an increase of two percentage points in 2024. In NBIM, the increase in the number of women is 10%. The share of women in Central Banking is unchanged. Over time, the trend is positive and the Bank is approaching the target of a minimum gender balance of 40% overall.

Table 4 Share of women and men per job category at Norges Bank’s head office in Oslo. Percent

|

Job category |

2024 |

2023 |

2022 |