Global Funding Flows Affect Local Lending and Spending in Advanced Economies

By Dominik Boddin, Bundesbank, Kasper Roszbach, Norges Bank and Daniel te Kaat, University of Groningen

In a financially highly interconnected world, the flow of capital between countries can potentially play an important role in shaping local financial markets. As banks have come to obtain more funding from abroad, cross-border capital flows increasingly affect the resources banks have at their disposal, influencing how they extend loans to households and businesses. Understanding these dynamics is important for policymakers aiming to ensure financial stability and understand how monetary policy, for example, spills over to other countries.

Research has shown that foreign capital inflows significantly increase bank lending through securities and interbank markets (Cetorelli and Goldberg, 2012; Temesvary et al., 2018), often shifting credit towards riskier firms and countries (Magud et al., 2014; Baskaya et al., 2017) and households (Garber et al. 2019). So far, research documents global banks as important transmitters of foreign financial shocks (Cetorelli and Goldberg, 2012; Iyer and Peydró, 2011), with emerging market economies being the most affected by such shocks.

In a recent Norges Bank working paper (Boddin, te Kaat and Roszbach, 2024), we shed light on how international wholesale bank funding surged after the ECB implemented unconventional monetary policies in 2014 and 2015, especially from non-euro area - into euro area banks. As the ECB started purchasing Euro denominated bonds, sellers of such bonds faced a choice between re-investing in riskier Euro assets, switching to other currencies or depositing the revenues at euro area banks. Many opted for the last option, and this generated a large increase in regional German banks’ funding. We detail how such banks’ lending, particularly to lower-income households and subsequently spending by these households, was affected. Our findings show that capital flows can directly shape credit supply in local markets, influencing which households gain access to loans. Importantly, we document that not only large global banks, but also smaller, regional banks play a key role in transmitting these international financial shocks. While much of the existing research has focused on emerging markets, we provide new evidence that these effects are also highly relevant for advanced economies like Germany.

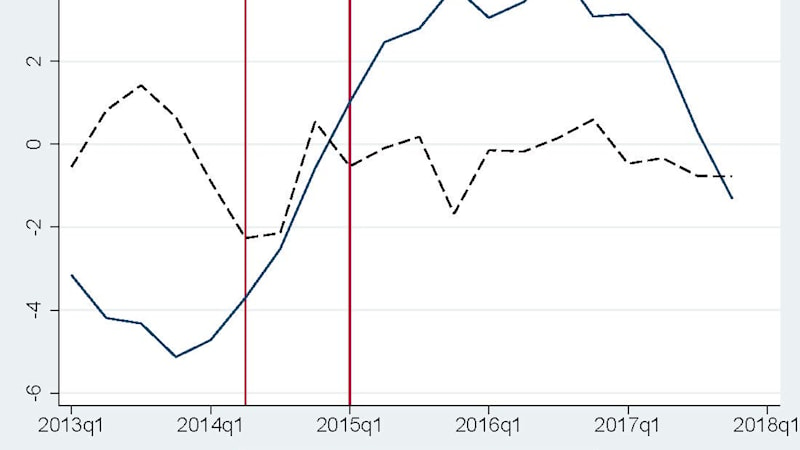

Panel C: Bank Inflows - Core vs Periphery

Supervisory Bank Data and Household Survey Data

To analyze these effects, we combine detailed bank-level regulatory data with granular household-level credit and consumption data from Germany. Our study leverages supervisory data from the Deutsche Bundesbank, covering bank balance sheets and funding structures, as well as the German Panel on Household Finances (PHF), which provides rich survey data on households’ income, debt, and spending patterns. By linking households to their primary banks, we assess how variations in bank exposure to foreign capital flows affect lending and consumption behavior. This allows us to identify which banks are most impacted by foreign inflows and how this, in turn, influences the borrowing behavior of different income groups.

Regional Banks Play a Role in Transmitting International Funding Shocks

Regional German banks that rely heavily on so-called non-core funding—such as interbank loans and securities markets, as opposed to core funding from retail deposits—were the biggest recipients of these inflows.

Our study highlights a clear mechanism through which cross-border bank inflows influence domestic credit markets. When foreign capital flows into the banking sector—such as during the European Central Bank’s (ECB) implementation of unconventional monetary policies in 2014 and 2015—regional banks with a greater reliance on non-core funding (such as interbank loans and securities markets) receive a disproportionate share of these funds. Unlike retail deposits, which are stable, these wholesale funding sources fluctuate with international financial conditions. Banks with weaker capital buffers are especially likely to channel these inflows into consumer lending, often extending credit to riskier, lower-income borrowers.

Lower-Income Households Received More Credit and Increased Spending

Banks subsequently increased lending, particularly consumer credit to lower-income households, who often face barriers to accessing credit. We show that low-income households experienced up to 83% higher growth in consumer loans compared to higher-income households when their bank had significant exposure to foreign funding.

Interestingly, mortgage lending remained unaffected, suggesting that the credit expansion mainly led to uncollateralized, short-term credit which is often more sensitive to financial conditions and riskier from a financial stability perspective. Foreign capital inflows thus primarily eased short-term borrowing constraints rather than boosting long-term, collateralized lending.

The credit expansion is primarily driven by the extensive margin, meaning that households who previously had no access to such loans became newly eligible to borrow. Our findings further show that lower-income households whose banks were more exposed to foreign funding experienced significantly higher credit growth.

The availability of credit had a real impact on household spending. Low-income families with access to these loans increased their spending on non-durable goods by nearly 29%, likely boosting their local economy but potentially raising concerns about the sustainability of such consumption changes.

Increased Risk-Taking

While increased credit access supports consumption and economic activity, it also raises questions about financial stability. Banks with weaker capital bases were more inclined to increase lending to lower income households, potentially exposing themselves to future financial shocks as these households typically face higher default risk. So, while banks with greater exposure to non-core funding saw a short-term increase in their profitability, as they were able to charge higher interest rates on unsecured consumer loans compared to traditional, collateralized lending, the shift towards riskier lending could have led these banks to become more vulnerable to future downturns in the economy.

Relevance for Norway

This study sheds new light on how international policy shocks trickle down to countries. Unlike earlier research, this study documents that not only global banks but also smaller, regional banks can transmit these shocks. Another new finding is that international shocks impact not only emerging market economies but also advanced economies like Germany, and eventually its households and their consumption behavior.

While this study focuses on Germany, the insights are highly relevant for Norway. As a small, open economy with significant international financial ties, the Norwegian banking sector is likely to be exposed to similar dynamics of cross-border capital flows. Understanding how foreign funding impacts lending behavior in Germany provides a valuable framework for understanding how Norway’s financial system may be affected by large shocks to global capital flows, for example, those resulting from the implementation of the ECB’s or Federal Reserve’s monetary policy.

The views expressed here are those of the authors and do not necessarily reflect those of the Bundesbank, the Eurosystem or Norges Bank.

0 Kommentarer