How stock market wealth fuels entrepreneurship

Entrepreneurship is a critical driver of economic growth, innovation, and wealth creation. In a recent paper joint with Gabriel Chodorow-Reich from Harvard University, Vitor Santos from BI Norwegian Business School and Alp Simsek from Yale School of Management we investigate how fluctuations in stock market wealth can influence individuals’ ability to launch new ventures. The findings underscore that gains in stock market wealth can facilitate business creation, especially for those with modest initial financial wealth. Moreover, stock wealth gains impact the size and profitability of the new business venture.

The role of wealth in business formation

Starting a business requires not only a compelling idea but also the financing necessary to cover startup costs and to operate at profitable scale. Whether would-be entrepreneurs can easily source these funds from financial markets or need to use their own wealth is still an open question with important policy implications for business dynamisms and productivity growth. Correlational evidence suggests that individuals with greater wealth are more likely to become entrepreneurs. However, measuring the causal relationship between own wealth and entrepreneurship is challenging. Wealthier individuals may have different characteristics, such as risk tolerance or business acumen, that independently make them more likely to start a business. Additionally, identifying the specific mechanisms by which wealth contributes to entrepreneurship – either by relaxing financial constraints arising from relatively costly external finance in the form of debt or external equity, or by increasing the consumption benefits from entrepreneurship, for example, from preferences for being one’s own boss – requires yet further analysis.

Addressing the identification challenge

To isolate the effect of wealth on entrepreneurial entry, our study leverages a unique dataset of household stock portfolios in Norway. This allows us to examine changes in stock wealth due to idiosyncratic variations in individual portfolio returns. Our approach essentially creates a “quasi-random” experiment, where differences in wealth stem from idiosyncratic differences in stock choices rather than from systematic portfolio differences. To understand the source of identifying variation, consider two people: Anna and Jon. Both have relatively modest financial wealth (around 180,000 NOK) but have a non-trivial share of that wealth (around 25,000 NOK) invested in one or two popular stocks on the Norwegian stock exchange – a typical behavior for direct holders of stocks. The reason for this under-diversification is usually speculation – trading in popular liquid stocks based on subjective beliefs rather than specific private information about the stock’s future performance. For example, Anna may view Orkla as a particularly promising investment, while Jon may think that Telenor will be the next blockbuster stock. The under-diversification inherent in their portfolios means that even though Anna and Jon hold very similar stock portfolios in terms of co-movement with the aggregate stock market (their market beta) or the average daily volatility of the portfolio, they would end up with very different ex post returns. By focusing on these idiosyncratic fluctuations arising from speculation, the study establishes a causal link between wealth and entrepreneurship: households that experience significant stock gains are more likely to start businesses than those without such gains.

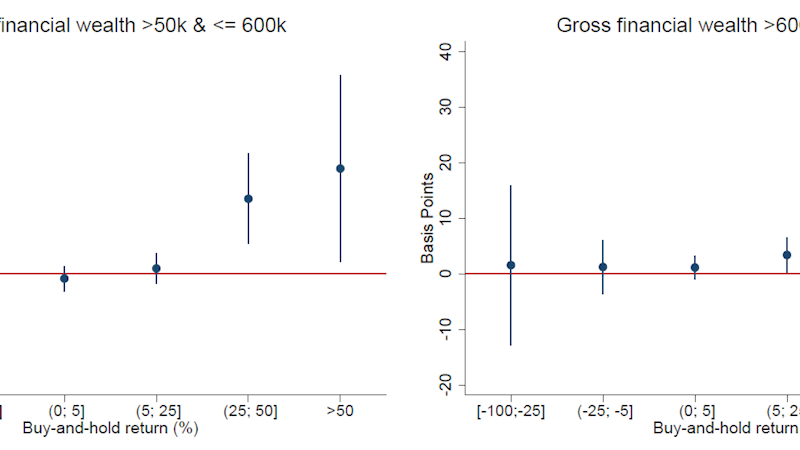

Figure 1 below shows graphically the main empirical findings. We find that when stock returns increase a household’s wealth by about 20%, the likelihood of that household starting a business rises by approximately the same proportion. This finding is particularly significant for households with moderate levels of initial wealth, pointing towards the importance of financial constraints.

Wealth’s impact on business size and profitability

Beyond merely enabling business formation, wealth may have important effects on the nature and potential success of the businesses started. In theory, wealth can also induce entrepreneurs to start larger more profitable firms. Identifying this mechanism, however, is more challenging, since even with random variation in wealth, entrants with high wealth tend to have a different (lower) productivity than entrants with low wealth. Using a general model of entrepreneurship choice we therefore show how to control for selection bias into entry and estimate how higher wealth impacts the size and profitability of the start-up.

Our selection-corrected estimates show that when individuals experience an increase in stock wealth, they not only become more likely to start a business, but they also tend to launch larger, more profitable ventures. Moreover, stock owners liquidate a portion of their stock portfolio and inject equity into the firm essentially one-to-one with the stock market gain they experience. These findings are consistent with stock wealth relaxing financial constraints over other possible explanations, such as preferences for being one’s own boss or a bout of optimism unleashed after a positive stock market return.

Overall, our findings point strongly towards financial constraints being an important impediment not only to business creation but also to the creation of larger, more profitable firms in the economy. Stock market wealth reduces these constraints by providing individuals with the capital needed to establish a larger and more profitable business.

0 Kommentarer

Kommentarfeltet er stengt