Estimating Hysteresis Effects in Norway

Will the current COVID-19 crisis have a long-run impact on the level of output and employment through hysteresis effects? Although the current recession is unusual in many dimensions, looking at experiences from the past can be useful to better understand the long-run effects of recessions. We do this in a simple empirical model where we allow fluctuations in aggregate demand to have long-run effects on output and employment. These demand shocks are found to be quantitatively important in Norway, but only if the banking crisis at the end of the 1980s and beginning of the 1990s is included in the sample. Large demand-driven recessions lead to persistent declines in employment, investment and output but leave labor productivity largely unaffected.

Macroeconomists are used to decomposing movements in real economic activity into an upward trend and transitory fluctuations around the trend, interpreted as business cycles. According to this conventional view, the trend is determined by supply-side factors, such as developments in technology and changes in labor supply, while the business cycle is mostly driven by shocks to the components of aggregate demand and monetary policy. The “independence assumption” that productive capacity is independent of monetary policy, and more generally of demand factors, has become the dominant paradigm in macroeconomics and is the basis of the inflation-targeting framework used by most central banks (cf. Blanchard 2018).

One alternative (and minority) view, popularized by Blanchard and Summers (1986), states that fluctuations in demand (and large recessions in particular) may have a permanent effect on the productive capacity of the economy through hysteresis effects. Economic developments in Europe in the 1980s seemed to support this view since unemployment was stabilizing at a higher level following every recession. However, the long period of stability referred to as the Great Moderation was interpreted by many economists as supportive of the conventional view, and research on hysteresis largely disappeared. The idea that recessions may have long-run effects has re-emerged in the aftermath of the Great Recession as estimates of potential output have been lowered continuously over several years. While some suggest that this is due to lower pre-crisis trends in productivity growth and labor supply masked by the boom in the pre-Great Recession period, Summers (2014) interpreted them as evidence of hysteresis and stated that: “Any reasonable reader of the data has to recognize that the financial crisis has confirmed the doctrine of hysteresis more strongly than anyone could have anticipated“.

In a recent paper (Furlanetto, Robstad, Ulvedal and Lepetit 2020) we run a horse-race between the conventional view and the hysteresis view. In our empirical model, we allow for (without imposing) hysteresis effects to play a role in economic dynamics. More specifically, we disentangle two shocks (rather than one) with potentially permanent effects on economic activity: a traditional supply shock and a more novel demand shock that are separately identified on the basis of the short-run co-movement between output and prices. Similarly, we also decompose the transitory shock into two components: a demand and a supply shock, both with zero long-run effect on output. We estimate our model over the sample 1983:Q1-2019:Q4 on US data on GDP, inflation, employment and investment. We are particularly interested the demand shocks with potentially permanent effects on output and find that these shocks are important drivers of GDP. Demand-driven recessions (and booms) lead to strong and persistent effects on employment and investment but leave labor productivity largely unaffected. In addition, we find that demand shocks trigger an increase in unemployment, a decline in participation and an increase in applications (and awards) for disability insurance. These results are consistent with the most commonly used explanations for hysteresis effects. Examples of such channels are skill depreciation, loss of morale and reduced employability of the long-term unemployed.

In this post, we present results for the same exercises on data for Norway over the period 1979:Q3-2019:Q4 on Mainland GDP, inflation (domestically produced consumer goods and services), employment and private investments (excluding oil investments).

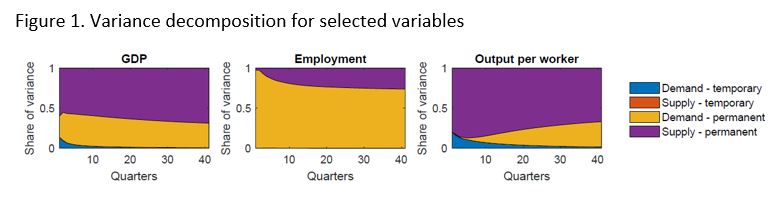

Our first result is on the relevance of hysteresis effects. Figure 1 plots how much of the variation of each variable is explained by the different shocks at different horizons. We find that demand shocks with potentially permanent effects are important in Norway: they explain almost 40 percent of long-run output fluctuations and around 80 percent of long-run employment fluctuations. These results imply that both supply-side and demand-side factors with long-run effects are needed to jointly explain the data.

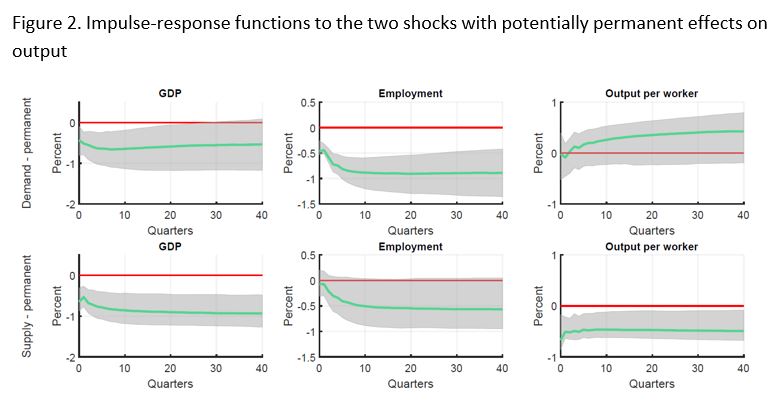

Our second result relates to the transmission mechanism of hysteresis effects. In Figure 2, we present impulse response functions to contractionary demand and supply shocks with permanent effects. To investigate the transmission mechanism in more detail we first decompose the long-run effect on output into an effect on employment and an effect on output per worker. We find that a decline in demand propagates almost exclusively through employment. Output per worker barely responds to the shock and, if anything, tends to increase. In contrast, output per worker drops sharply and durably in response to a supply shock, thereby showing that that the two shocks with permanent effects transmit to the economy in meaningfully different ways.

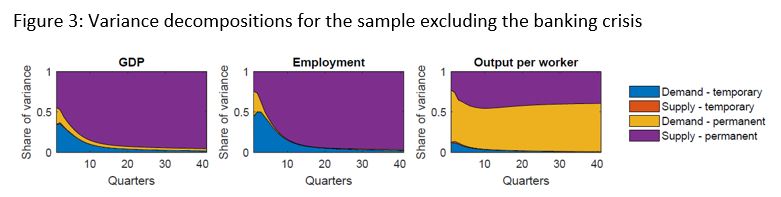

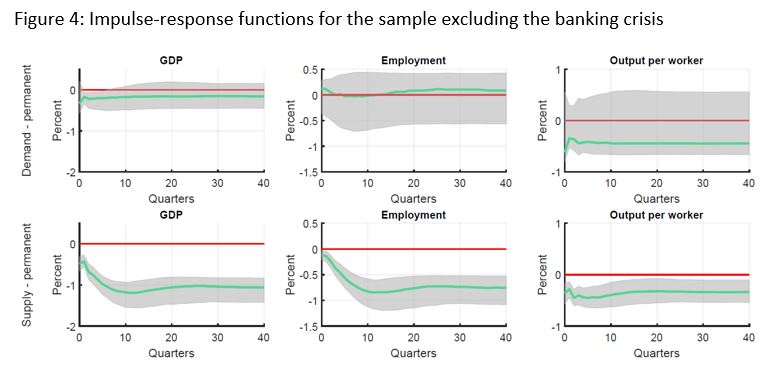

So far, our results support the presence of rather strong labor market hysteresis in Norway. However, this conclusion is completely turned on its head when we re-estimate the same model over the period 1993-2019, see Figures 3 and 4. Results over this period are now much more in line with the standard view of economic fluctuations. The role of the demand shock with potentially permanent effects is now rather marginal and we do not find evidence for hysteresis effects on employment. Therefore, the important role for permanent demand shocks seems to be related to the banking crisis at the end of the 1980s and beginning of the 1990s, arguably the largest recession that Norway has experienced in recent times, at least prior to the corona crisis.

All in all, we find evidence (both for Norway and the US) that demand-driven fluctuations have long-lasting effects on the labor market, as long as large recessions are included in the sample period. We believe these empirical findings may be of particular relevance today as economists and policymakers are trying to assess the long-run scarring effects of the current COVID-19 crisis.

References

Blanchard, O., (2018): “Should we reject the natural rate hypothesis?” Journal of Economic Perspectives, 32(1), 97-120.

Blanchard, O., and L. Summers (1986): “Hysteresis and the European unemployment problem” NBER Macroeconomics Annual, 1, 15-78.

Furlanetto, F., Ø. Robstad, P. Ulvedal, and A. Lepetit (2020): “Estimating hysteresis effects” Norges Bank Working Paper 13/2020.

Summers, L. (2014): “Fiscal policy and full employment” Speech at Center on Budget and Policy Priorities Event on Full Employment.

0 Kommentarer

Kommentarfeltet er stengt