The Forward Guidance Puzzle

‘Forward guidance’ refers to central banks’ signaling about future interest rate setting. In standard New Keynesian models, forward guidance is so effective that the effect today of an announced future interest rate cut is larger the further into the future the cut is supposed to happen. This feature seems highly implausible and has been dubbed “the forward guidance puzzle”. In this blog post, we explain the nature of the forward guidance puzzle and investigate how relevant it is for Norges Bank’s macroeconomic model NEMO. Moreover, we discuss briefly how NEMO could be improved so that the effects of forward guidance become more realistic.

Forward guidance in the standard New Keynesian model

In practice, forward guidance usually concerns the policy rate, which is a nominal interest rate. However, before looking into that, it helps sharpen our intuition to start with the assumption that the central bank announces a future cut in the real interest rate, since the real interest rate is the one that matters for agents’ decisions in these models. Since the announced real interest rate decline leads to higher inflation, the nominal interest rate (policy rate) has to be increased in order to keep the real rate constant until it is cut.

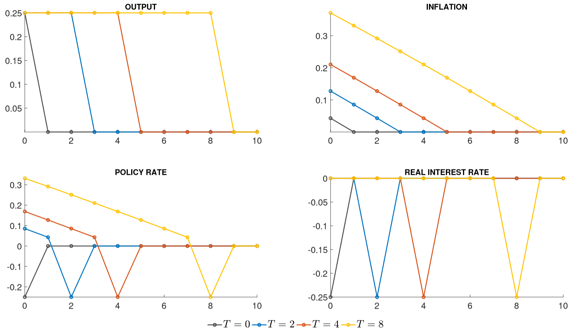

| Figure 1. Forward guidance about the real interest rate. |

Figure 1 illustrates the puzzle in a simple textbook New Keynesian model, which is described in more detail here. All variables are measured as deviations from steady state, so that all variables are zero in absence of forward guidance. The black curves show the effect of reduction in the real interest rate today that lasts for one quarter. The effect on inflation is small and short-lived. The blue curves represent the effects of an announcement of a cut 2 quarters ahead. Output increases by the same amount as with the immediate rate cut, but stays at this higher level until the real interest rate returns to normal. The immediate effect on inflation is higher with forward guidance than with an immediate cut. Since by construction, the real interest rate shall not change until in period 2, the nominal interest rate must be raised in order to prevent an immediate decrease in the real interest rate due to higher inflation. The red and yellow lines illustrate rate cutes further ahead.

We see that the immediate effect on output is independent of when the real interest rate is expected to decrease. This is because in standard New Keynesian models, aggregate demand does not depend on the current real interest rate alone, but on the sum of expected real interest rates from today and to infinity. However, since the immediate effect is the same, the duration of the positive output gap is longer the further into the future the rate cut is expected to take place. Inflation depends on the entire expected future path of the output gap, and not just on current output, so that the immediate increase in inflation is larger the further into the future the real interest rate is expected to decrease. It is not really a “puzzle”given how these models are specified. The property is mainly an implication of the cocktail of sticky prices, complete markets and rational expectations, which are key assumptions in these models. But although not really a ‘puzzle’, it is arguably implausible.

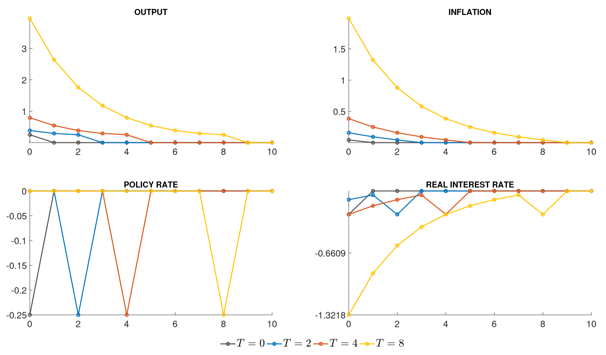

| Figure 2. Forward guidance about the nominal interest rate (policy rate). |

Let’s now consider forward guidance about the nominal interest rate (policy rate), which is illustrated in figure 2. An announced cut in the nominal interest rate at some time in the future leads to higher inflation, which exacerbates the decrease in the real interest rate in this case. Keeping the nominal interest rate unchanged until the cut thus makes monetary policy expansionary also before the actual rate cut. This is in contrast to the case with forward guidance about the real rate, where the nominal rate was raised to offset the effect of lower real interest rate due to a rise in inflation. Therefore, forward guidance about the future nominal interest rate has stronger effect than forward guidance about the future real interest rate. In models with somewhat richer dynamics, this additional effect may even imply unstable dynamics, so that the effect of switches sign when the forward guidance horizon exceeds a certain length.

Due to the unrealistic effects of forward guidance in New Keynesian models, there have been attempts in the literature to change some of the assumptions in order to make the effects of forward guidance more reasonable. Deviations from rational expectations and incomplete markets are two ingredients that have been shown to fix, or at least attenuate, the puzzle (see Staff Memo for references).

What about NEMO?

DSGE (Dynamic, Stochastic, General Equilibrium) models used by central banks for policy analysis share many of the ingredients in the simple New Keynesian model, despite featuring a lot of extensions that are added to match data better. NEMO is a DSGE model used by Norges Bank as the core model for forecasting and policy analysis. (For a more detailed description of NEMO, see here). Norges Bank has, since 2005, been publishing forecasts of the policy rate for the three following years. This can be considered a quite explicit type of forward guidance. Since NEMO is used for producing these forecasts, one would like the power of forward guidance to be reasonable in this model.

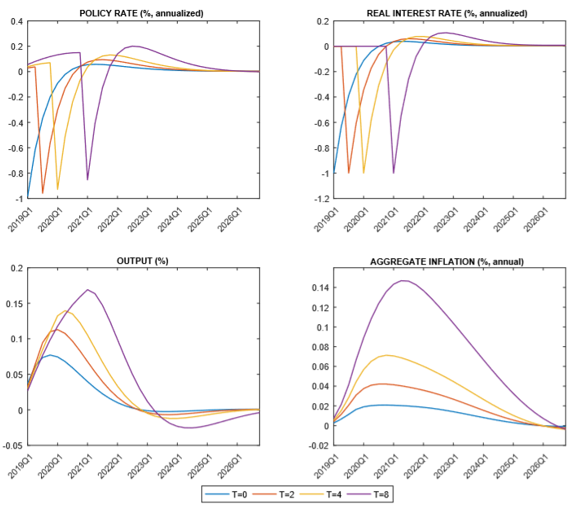

| Figure 3. Forward guidance about the real interest rate in NEMO. |

Figure 3 shows the effect of forward guidance about the real interest rate in NEMO. The immediate effect of forward guidance is smaller in NEMO than in the textbook model, because the frictions in NEMO imply more gradual adjustments. In addition, because of high inflation persistence in NEMO, monetary policy needs to be contractionary for some periods following the interest rate cut, in order to bring inflation back to the target. The agents in the model anticipate this and, as a result, the effects of forward guidance become somewhat muted. But this does not mean the effect of forward guidance is more realistic. It just means that the unreasonable expansion due to the future rate cut is partly killed by an unreasonably large contraction in response to post-guidance policy. This effect differs from the simple New Keynesian model without persistence, where inflation will return to target when the real interest rate is set to neutral.

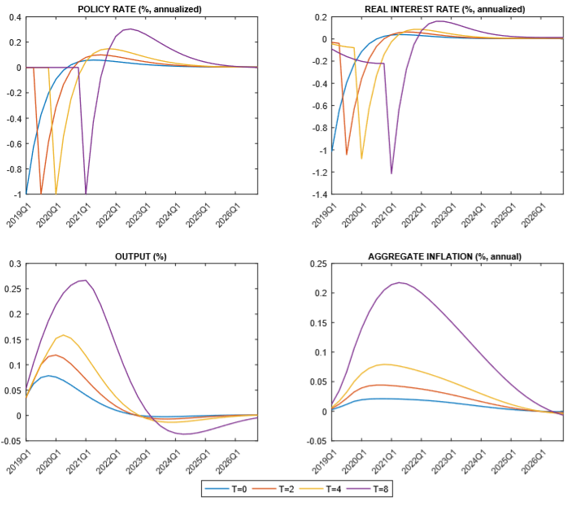

| Figure 4. Forward guidance about the nominal interest rate in NEMO |

Let us now turn to forward guidance about the nominal rate in NEMO. Figure 4 confirms that the power of forward guidance is considerably higher for the nominal interest rate than for the real rate, especially when considering the peak effects on output and inflation. What the figure does not show, but which you can read in our Staff Memo, is that the effects become so large that the sign switches, so that an announced interest rate cut has a negative effect on output and inflation, if the cut happens 14 quarters ahead or more. This is due to the instability problem mentioned above, where the sign can change. This is well known in the literature (see for example Carlstrom, Fuerst og Paustian). This perverse effect of forward guidance is hardly relevant in practice and should be regarded as a sort of “bug” in standard DSGE models. When using such models for policy analysis, one thus has to be careful when modelling forward guidance.

All models have strengths and weaknesses, and we always add considerable judgment when using models for policy decisions. But even if we have ways to make the effects more realistic, we work continuously on improving NEMO. One feature that we consider adding to the model is “overdiscounting” of the future, as suggested by Gabaix. This makes agents in the model more myopic and reduces the power of forward guidance. We do believe that future guidance has some effect. But we also believe that what we do with the interest rate today is more important for current spending and pricing decisions than what we say we’re going to do far into the future. We would like models that we use for monetary policy analysis to have this property.

0 Kommentarer

Kommentarfeltet er stengt