How important is the ECB for Norwegian interest rates?

If you have ever taken a course in international economics, you have probably been taught about the (Mundell-Fleming) ‘trilemma’: the inability to achieve i) a fixed exchange rate, ii) free capital mobility, and iii) autonomous monetary policy at the same time. A country needs to sacrifice one to obtain the other two goals. This implies that if a country has free capital mobility and wants to have an independent monetary policy, it needs to have a floating exchange rate. Therefore, Norges Bank can achieve price stability, whereas the Danish central bank’s main task is to maintain a stable exchange rate between the Danish krone and the euro.

However, over the past few years, some economists have started to argue that in the current highly globalized world, even countries with floating exchange rates might not be able to have independent monetary policies. It was mostly Helene Rey (2015) who argued that global financial integration (and in particular something she coins ‘the global financial cycle’) reduced the ‘trilemma’ to a ‘dilemma’: only when a country manages its capital account can it maintain monetary policy autonomy.

Several economists have provided evidence in favor and against this claim. In an earlier blog post Ragna Alstadheim looked at the effects of the global financial cycle on Norwegian capital flows, and concludes that it is global real activity, rather than the financial cycle, that determines capital flows. In a new working paper (co-authored with Nina Midthjell and Edvard Jansen) I investigate to what extent monetary policy and communication from the ECB affects interest rates and equity prices in Norway and Sweden, and whether this implies that Norges Bank and Sveriges Riksbank lose the ability to affect interest rates with domestic monetary policy. For this blog I will focus on the Norwegian results.

Spillovers from ECB

To assess the effect of ECB’s monetary policy on Norwegian financial variables, I consider two dimensions of its monetary policy (see here for details): a target surprise caused by unexpected changes in the ECB’s key policy rate, and a path surprise caused by unexpected changes in the ECB’s communicated stance about the future. One can interpret the first as a conventional monetary policy effect, and the second as a communication effect. How strong are the spillovers from ECB’s monetary policy and communication on Norwegian financial variables?

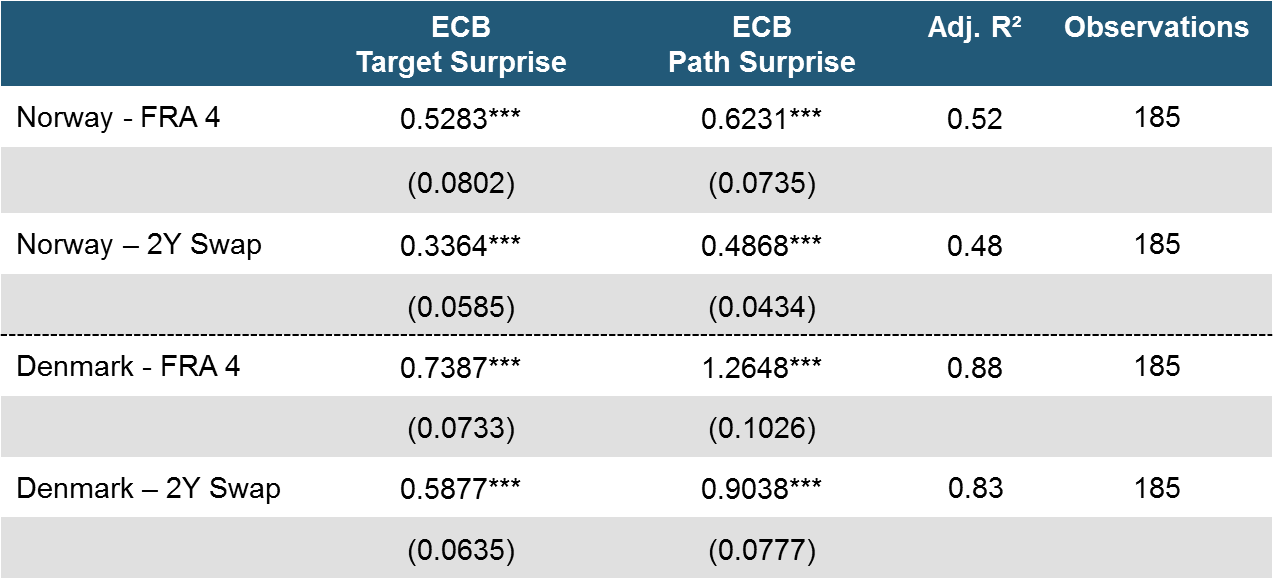

Table 1: Spillovers from ECB’s monetary policy (target surprise) and communication (path surprise) on Norwegian and Danish interest rates. FRA 1: three-month interest rate one quarter out. FRA 4: three-month interest rate four quarters out. 2Y Swap: average interest rate over the coming two years. HAC standard errors in brackets.

You can see from the results in Table 1 that spillovers are substantial. For example, a 10 basis points surprise change in the European key policy rate leads to a 5.3 basis points change in the Norwegian three-month interest rate four quarters out (‘FRA 4’). A surprise in ECB’s communication leading to a 10 basis points increase in the European one-year rate leads to a 6.2 basis points change in the Norwegian FRA 4. However, although the spillovers are strong, they are even stronger for a country without monetary policy autonomy, namely Denmark. In some cases the spillovers are as much as twice as big. That indicates that Norway is affected by ECB’s monetary policy, but not as much as a country that has given up its monetary autonomy.

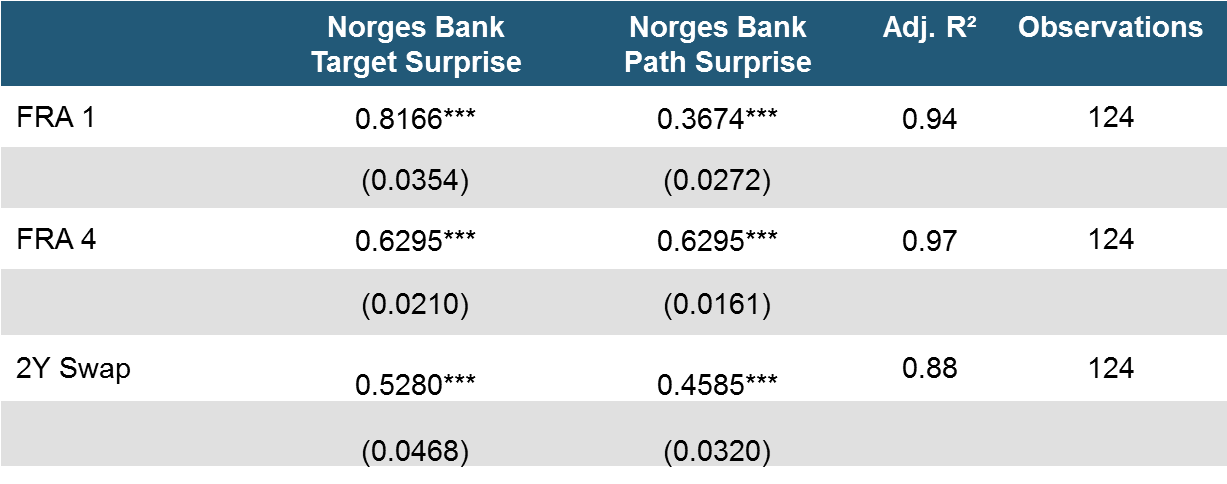

Given such spillovers from the ECB, one might start wondering whether Norges Bank can still affect domestic rates. Comparing the domestic effects to the effects of ECB spillovers (Table 2 versus Table 1), it is clear that Norwegian monetary policy has a strong effect on Norwegian rates, especially up to two years. We cannot compare the size of the effect of communication (‘path’) between ECB’s spillovers and Norges Bank’s domestic effect due to different scaling of those variables, but we can see that Norges Bank’s communication also has a strong and significant effect on domestic interest rates.

Table 2: Effects of domestic monetary policy (target surprise) and communication (path surprise) on Norwegian interest rates. FRA 1: three-month interest rate one quarter out. FRA 4: three-month interest rate four quarters out. 2Y Swap: average interest rate over the coming two years. HAC standard errors in brackets.

Do these effects last?

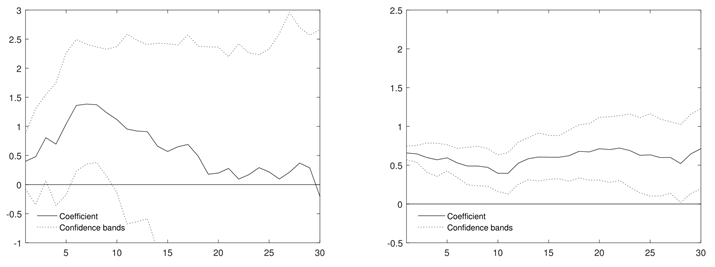

You may argue that what happens in a 2-3 hour time window around monetary policy announcements (which is what we focused on so far) is not necessarily representative for the longer lasting effect of either ECB’s or Norges Bank’s monetary policy. We have therefore also looked at how persistent these effects are. Figure 1 first compares how long lasting the effect of a monetary policy surprise on the Norwegian FRA 4 rate (three-month interest rate four quarters out) is, coming from either the ECB or Norges Bank. The vertical axis shows the basis points change in the domestic rate in response to a basis point surprise rate in the European key policy rate (left figure) or Norwegian key policy rate (right figure). The horizontal axis shows the number of trading days since the monetary policy announcement. The effect of Norges Bank’s monetary policy is more stable and persistent. So, domestic monetary policy is quite effective for rates of this horizon.

Figure 1: The persistence of the effect of a target surprise on Norwegian three-month interest rate four quarters out (FRA 4) coming from the ECB (left figure) or Norges Bank (right figure).

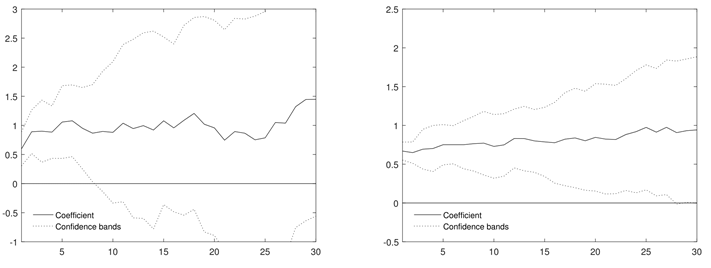

We also look at the effect of communication: do spillovers from ECB’s communication have a long lasting effect on Norwegian rates? Figure 2 shows the effect of communication on the same Norwegian interest rate as before. We can see that communication from both sources has quite a long lasting effect on Norwegian interest rates. The effect of ECB communication is more uncertain though, as can be seen from the wide confidence bands.

Figure 2: The persistence of the effect of a path surprise on Norwegian three-month interest rate four quarters out (FRA 4) coming from the ECB (left graph) or Norges Bank (right graph).

The trilemma is still alive!

Recent research suggests that due to global financial integration and spillovers from the major central banks, central banks in small economies lose control over their domestic yield curve. In this blog I have summarized the results from a new Norges Bank working paper that investigates this claim for Norway. I conclude that, despite the obvious spillover effects from ECB’s monetary policy and communication on Norwegian rates, domestic monetary policy is still very effective in moving domestic rates. No need to take a new course in international economics: the trilemma is still alive!

0 Kommentarer

Kommentarfeltet er stengt